Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Ratos's SEK 1.4bn share emission fully subscribed

Ratos's emission of class-C preference shares to increase its share capital has been fully subscribed, generating proceeds of close to SEK 1.4bn in total before issuing costs.

LDC provides Forest Holidays with follow-on funding

Rural holiday accommodation provider Forest Holidays has opened its eighth site with follow-on funding from LDC.

Altor's Elixia merges with Sats and Fresh Fitness

Altor Equity Partners and TryghedsGruppen have agreed to merge Nordic fitness chains Sats, Elixia, Fresh Fitness, Safe and Metropolis.

EQT and GIC opt for Springer Science IPO

EQT and GIC's plans for a potential trade sale of German media publisher Springer Science to BC Partners have definitely been scrapped as the owners firmly focus on a listing.

Gimv backs €40m investment in Lampiris

Gimv has jointly invested €40m in Belgian green energy supplier Lampiris with the Regional Investment Company of Wallonia (SRIW).

Harris Williams opens Frankfurt office

Mid-market investment bank Harris Williams & Co has opened a second European office in Frankfurt.

Bridges sells The Gym Group to Phoenix

Bridges Ventures has sold a majority stake in The Gym Group to Phoenix Equity Partners, realising a 3.7x money multiple and a 50% IRR.

Tar Heel backs Rockfin in first investment from Fund II

Tar Heel Capital has acquired a 60% stake in Rockfin, a Polish supplier of hydraulic and pressure systems.

Greylock Partners et al. invest $15m in Wrapp

Greylock Partners, Atomico, Creandum and other backers have invested $15m in a series-B funding round for mobile gifting service Wrapp.

LGV's Heywood steps down

LGV Capital CEO Ivan Heywood has stepped down and will be replaced by current managing directors Michael Mowlem and Bill Priestly.

EQT's Munksjö lists on Nasdaq OMX Helsinki

Shares in EQT-backed speciality paper producer MunksjУЖ have started trading on the Helsinki Stock Exchange.

Vaaka Partners Buyout Fund II holds final close

Vaaka Partners has held a final close for Vaaka Partners Buyout Fund II on its тЌ150m hard-cap.

European Capital exits MTH

European Capital has sold German company Metall Technologie Holding GmbH (MTH) to LOI Thermprocess GmbH, reaping a 1.6x multiple on its original investment.

Ingenious sells Digital Rights to Modern Times for £13.2m

Ingenious Media Active Capital (IMAC), a closed-ended investment company managed by Ingenious Ventures, has sold its stake in Digital Rights Group (DRG) to Swedish broadcaster Modern Times Group (MTG) for ТЃ13.2m.

Dechert makes new hires for Paris branch

Matthieu Grollemund, Dechert

Carlyle MDs Falézan and Colas to leave next year

Franck FalУЉzan and Benoit Colas, two Carlyle managing directors with a focus on French buyouts, are set to step down in May next year.

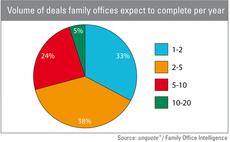

Family offices seek surge in deal origination

Family offices

Key Capital Partners' Dwell close to administration

Furniture retailer chain Dwell could file for administration as early as this week, according to reports.

Sentica's atBusiness merges with Innofactor

Sentica Partners Oy has sold Finnish technology company atBusiness to Innofactor.

HG International trades hands between Gilde funds

Gilde Equity Management Benelux (GEM) has sold Dutch cleaning products supplier HG International BV to the GP's sister division, Gilde Buyout Partners (GBP).

Uniqa to sell $665m private equity portfolio

Austrian insurance company Uniqa Versicherungen is planning to offload $665m of private equity positions ahead of Solvency II.

EQT's Springer Science still in dual-track process

BC Partners is reportedly left as the sole bidder for EQT portfolio company Springer Science, which announced IPO plans last week.

LBO France to team up with Fosun for Nocibé bid

French firm LBO France could make a joint bid with Chinese conglomerate Fosun for Nocibé, the French perfume and cosmetics retailer owned by Charterhouse, according to reports in the local press.

Herkules picks up Umoe Schat-Harding and Noreq

Herkules Private Equity has acquired life-saving equipment companies Umoe Schat-Harding and Noreq in a combined transaction.