Southern Europe

21 Partners buys Poligof

Second purchase from Poligof's Invetimenti III fund

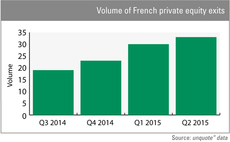

French exit activity continues rebound in Q2

GPs across Europe continue to take advantage of seller's market

Mega-buyout bonanza: Q2's five largest deals

Taking stock of the five largest European buyouts inked in the past quarter

BlackFin holds €300m second close

Interim close puts GP on track to hit €400m hard-cap

Mid-cap PE valuations back to pre-crisis heights – Argos research

PE houses and corporates neck and neck on pricing

Espiga acquires 35% stake in Ubis

Maiden deal for Espiga Equity Fund

Ardian buys majority stake in IRCA

Fifth investment in Italian market for GP’s mid-cap funds

Partners Group takes minority stake in Tous

Founding family will keep majority control of luxury goods maker

MBO Partenaires acquires 22% stake in Llorente & Cuenca

Investment marks firm’s maiden deal in Spain

Funds-of-funds fight for survival

unquote" checks the pulse of the troubled funds-of-funds market

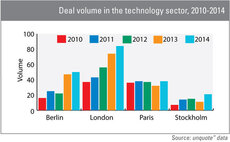

Tech Cities: European capitals house growing number of tech deals

From Paris to Berlin, European capital cities see uptick in tech deals

Idinvest closes latest debt fund on €400m

Exceeds target by тЌ100m

Turnarounds still struggling to take off

Turnaround deals throughout Europe remain at low levels

Family office perspective: a new breed of PE emerges

A new breed of deal-by-deal managers appears to be meeting the needs of family offices

Family office perspective: turning away from traditional PE

A two-part, in-depth look at what family offices think of private equity

Market Insight: UK consumer sector refinancings

A detailed look at trends in the refinancing market

Clessidra buys 80% stake in Arredo

Company's EBITDA stood at €30m in 2014

3i promotes eight worldwide

Firm acquired majority stake in Euro-Diesel earlier this week

Corporates outspend PE houses in mid-market, says Argos research

Mid-cap LBO valuations back to late-2013 levels, analysis reveals

Apax divests Banca Farmafactoring to Centerbridge

Deal follows scrapped IPO plans

Summit invests in DentalPro

Existing investor VAM Investments has reinvested as part of the deal

In Profile: Corvm Capital Partners

Corvm Capital Partners adds to list of new firms using deal-by-deal model

Suma appoints two

Spanish GP recruits two professionals to its cleantech team

Private equity's tax model under scrutiny

As governments seeks to reduce deficits, PE's treatment of tax is under scrutiny