Southern Europe

Caixa participates in €3m round for Gigas

Caixa Capital Risc has committed capital to the €3m funding round for technology infrastructure and cloud hosting service provider Gigas.

Southern Europe unquote" October 2012

The aim of social-impact investment is to back companies that seek to solve the challenges society faces.

PAI partners acquires Marcolin in €207m LBO

PAI partners has agreed to acquire a 78.39% stake in listed Italian eyewear manufacturer Marcolin at a price of €4.25 per share.

Fondo Strategico Italiano prepares bid for Ansaldo Energia

Fondo Strategico Italiano will make a non-binding offer to acquire around 30% of power plant construction business Ansaldo Energia, according to reports.

HIG Europe backs Vértice 360 Servicios Audiovisuales

HIG Europe has acquired a 49.99% stake in Spanish audiovisual group Vértice 360 Servicios Audiovisuales (VSA) for €16m.

Bain buys Telefónica unit for €1bn

Bain Capital has agreed to the acquisition of Atento, the call-centre unit of Spanish telecommunications giant Telefónica, for €1.04bn.

Oltre tackles the big issue

Social impact investing, where funds target opportunities which offer a social as well as financial return, are taking off in some parts of Europe. However, in Italy they are a rare sight. Amy King reports

360 Capital holds first closing of venture fund

Venture investor 360 Capital Partners has held a first close on its second fund, 360 Capital 2011, on more than тЌ60m.

BDMI backs Nonabox

Bertelsmann Digital Media Investments (BDMI) has led a funding round for Nonabox, a Spanish online retailer of pregnancy and infancy products.

Paine acquires stake in Eurodrip from Global Finance

Paine & Partners has acquired a 67% stake in Athens-listed Eurodrip from Global Finance's Aquanova and another shareholder in a deal valued at €100m.

Kibo launches €45m fund

Kibo Ventures has launched a €45m fund to back internet and mobile start-ups, and held a first close on €42m.

Cashing in on the drive for efficiency

Austerity politics can often seem at conflict with the idealised world of cleantech and renewable energy. With governments scaling back subsidies to reduce their deficits, it might seem that green investing will have slipped out of fashion. However, tough...

Vertis backs LinkPass with €1m

Southern Italian investor Vertis has injected €1m into professional networking app LinkPass.

Investindustrial and Trilantic buy Euskaltel

Investindustrial and Trilantic Capital Partners have acquired 48% of Basque telecommunications provider Euskaltel through the holding company International Cable Holdings.

Four European mid-cap players team up, create Private Equity Network

Activa Capital, Graphite Capital, ECM and MCH have launched the Private Equity Network (PEN), a pan-European initiative designed to help their portfolio companies expand internationally.

Just-Eat bolts on SinDelantal.com

Just-Eat, the online takeaway ordering service backed by an investor consortium, has acquired its Spanish equivalent SinDelantal.com.

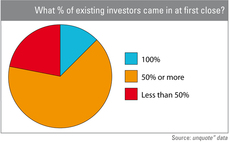

Fundraising research reveals optimism in tough times

Despite talk of apocalyptic investor behaviour, most GPs announcing a close this year reported existing LPs re-upping Т and even increasing ticket sizes, as revealed in an unquote" survey of more than 40 European GPs. Anneken Tappe reports

TLcom backs Beintoo with $2m

London-based VC TLcom Capital has injected $2m into Beintoo, an Italian provider of loyalty programmes for apps and websites.

Shareholders reject Trilantic's bid for Euskaltel

Shareholders in Basque telecommunications group Euskaltel have rejected Trilantic’s bid for the company due to disagreements over the company’s valuation, according to reports in the Spanish press.

Video: David Currie - industry needs liquidity

As he steps down from 33 years in private equity, most recently with SL Capital, David Currie shares his views on the industry's future.

N+1 buys majority stake in Secuoya

Spanish GP N+1 has acquired a 55% stake in audio-visual services and television content provider Grupo Secuoya.

Teaching firms how to grow

Education is playing an increasingly pivotal role in a GP's strategy to drive the growth of its portfolio companies. Amy King investigates

AXA PE buys 70% stake in Bruni Glass

AXA Private Equity has acquired a 70% stake in Italian glass containers producer Bruni Glass.

Software top destination for investment in 2012

A string of major software & computer services buyout deals have made the sector Europe's most invested in since the beginning of 2012, according to unquoteт data.