Southern Europe

Debt providers: "One-stop shops" gaining ground

Faced with a tough bank lending environment, PE houses are increasingly turning to тone-stop shopsт to leverage their deals. Indeed, alternative debt providers are looking forward to a busy 2012, as Greg Gille finds out.

Ade Gestion exits Jamones Burgaleses

Ade Gestion Sodical has exited processed meats producer Jamones Burgaleses, selling its 20% stake to Campofrio Food Group (CFG).

La Caixa backs vLex

La Caixa has led a €4m investment in online legal research platform vLex alongside reinvestment from shareholders, public money from the Spanish government’s Plan Avanza initiative and the European Network and Information Security Agency. La Caixa invested...

Axis invests in Industrias Hidráulicas Pardo

Axis Participaciones Empresariales has invested an undisclosed amount in hospital equipment manufacturer Industrias Hidráulicas Pardo, part of the Grupo HCS and a portfolio company of MCH Private Equity.

Gestión de Capital Riesgo backs Kondia Me Taldea

Gestión de Capital Riesgo del País Vasco (GCRPV), the venture arm of the Basque Country government, has injected €750,000 into machine tools manufacturer Kondia Me Taldea in exchange for a 22.5% stake.

Baring exits Centro Inmunológico de Cataluna

Baring Private Equity Partners has completed the exit of medical diagnostics company Centro Inmunológico de Cataluna (CIC) through a trade sale to French medical diagnostics company Labco.

Could mega fundraisings cause Nordic dry powder problem?

International investors have driven Nordic fundraising to unprecedented levels, but will deal flow keep up with the dry powder? Sonnie Ehrendal investigates.

Cabiedes & Partners reinvests in Uvinum

Cabiedes & Partners has led a second round of funding for online marketplace for alcoholic beverages and gourmet products Uvinum, investing a total of €830,000 from its fund and business angels.

Ventizz and Partners Group acquire Rioglass from GED

Ventizz Capital Partners and Partners Group have acquired solar reflectors manufacturer Rioglass Solar Holding SA from private equity firm GED.

Dechert opens in Frankfurt; poaches Mayer Brown partner

Private equity specialist Dr. Benedikt Weiser will join Dechert next month from Mayer Brown, where he was head of the firmтs German Private Investment Funds group.

Active Venture backs Whisbi

Active Venture Partners has backed start-up online communications service provider Whisbi.

Vector exits Efectivox

Vector Capital has sold its 27.67% stake in cash handling and transportation services provider Efectivox, previously known as Blindados Grupo Norte, to Swedish cash handling company Loomis. Financial details of the exit remain undisclosed.

Concerns over "unfair" Fondo Italiano

Italy’s Fondo Italiano has been on a roll in recent weeks, completing five deals in just seven days over the festive period. But mid-market professionals in Italy are concerned the government-backed fund could be introducing unfair competition. Amy King...

Syntegra returns to fundraising after seven years

Syntegra Capital has confirmed that it is raising a new fund. The firm expects to hold a first closing on тЌ75m in the first quarter of 2012. Amy King reports

PEP invests €18m in Allsystem

Private Equity Partners SGR (PEP) has injected €18m into Italian security company Allsystem Group in exchange for a significant minority stake. Investment took place through Private Equity Partners Fund IV, which closed on €300m in 2007.

Moleskine attracts PE buyers

Private equity players are thought to be circling Syntegra and Index-backed Italian notebook and diary brand Moleskine.

Buyers circle Permira-backed Valentino

Permira-backed Valentino Fashion Group has attracted the interest of potential buyers following its successful turnaround, according to reports in Il Sole 24 Ore.

Fondo Italiano to invest in venture capital funds

Fondo Italiano di Investimento has pledged to boost start-up growth in Italy by investing in venture capital funds. The fund is set to make investments of up to €50m from its €1.2bn of assets under management to help young Italian companies grow.

unquote" private equity barometer - Q3 2011

Deal activity levels fell by more than a third in Q3 2011 due to ongoing fears regarding the European debt crisis, according to the latest unquoteт Private Equity Barometer, in association with Arle Capital Partners.

DN highlights venture revival

Six exits in 18 months; two portfolio companies bought by Oracle in 2011 alone. One firm is living the dream. Kimberly Romaine reports.

Fondo Italiano-backed Arioli acquires Brazzoli

Fondo Italiano di Investimento has reinvested in textile machinery manufacturer Arioli to facilitate the company’s acquisition of 100% of Brazzoli, a manufacturer of textile dyeing machines. Varese Investimenti provided co-investment.

Suma acquires 48% of GEC and takes control

Spanish private equity firm Suma Capital has acquired a further 48% of Barcelona-based e-learning company Gestión del Conocimiento (GEC) from Caixa Penedès, increasing its stake in the business to 98%.

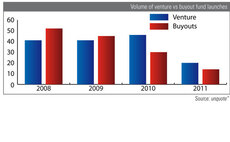

Volume of buyout vs venture fund launches

In 2010, launches of venture funds surpassed buyout funds for the first time in 5 years, but the gap has narrowed in 2011.

Access Capital Partners closes fund on €500m

Access Capital Partners has held a final close of its fifth European small- and mid-market fund-of-funds, Access Capital Fund V Growth Buy-out Europe (ACF V), on тЌ500m т above its initial target of тЌ350m.