Southern Europe

Park Square Capital Partners IV closes on €1.8bn

Fund invests in primary and secondary subordinated debt in both performing credit and dislocated debt

NB Aurora buys 30% stake in Veneta Cucine

Investor plans to boost Veneta Cucine's growth, consolidate its market position and further bolster its expansion

Xenon closes small-cap fund on €85m

Xenon Small Cap Fund is dedicated to investments in Italian companies generating EBITDA of up to €3m

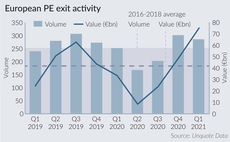

European PE exits back to historic highs in Q1

Greater visibility on the pandemic's impact, attractive comparables and PE's strong appetite on the buy-side embolden managers

Seco floats in €397m IPO

Sellers include FII, which owns a stake in Seco via its Fitec fund, and the company's founders

Hg sells EidosMedia to Capza

Sale ends a six-year holding period for Hg, which acquired a majority stake in Eidosmedia firms Wise and Aksia

GP Profile: Quadrivio plots busy investment schedule for 2021

Quadrivio co-founding partner and CEO Walter Ricciotti discusses the firm's latest fundraises, portfolio performance and upcoming investment pipeline

Founders Circle closes third fund on $355m

Fund deploys flexible capital to meet the needs of growth-stage companies and support their expansion

Fundraising fortunes: prevailing LP preferences persist

Alessia Argentieri looks at the winning strategies, and gathers insight from placement specialists as to what the rest of 2021 has in store

Meridia exits food ingredients producer Sosa

This is the second exit inked by the GP's debut fund, Meridia Private Equity I, following the sale of KIpenzi

Tikehau's SPAC Pegasus raises €500m

Tikehau, FinanciУЈre Agache, Jean-Pierre Mustier and Diego De Giorgi commit to invest a total amount in excess of тЌ165m

Greyhound leads $160m series-D for TravelPerk

This injection, which includes both equity and debt, brings the total capital raised by TravelPerk to date to $294m

Ares closes Ares Capital Europe V on €11bn

Ace V is Ares' largest institutional fund yet and is 70% larger than its тЌ6.5bn predecessor

Corpfin sells Secna to EQT's Chr Hansen

Sale ends a six-year holding period for Corpfin, which bought a 51% stake in the company via its €255m fund IV

Capza closes fifth debt fund on €1.6bn, prepares new launch

Fund invests in SMEs with EBITDA of more than €12m, providing unitranche and mezzanine

Bain sells Fedrigoni's security business to Epiris's Portals

Sale comprises Fedrigoni's facilities specialised in the production of security paper for banknotes and documents

Arcline buys PTS from Columbus

Arcline intends to boost PTS's growth through the expansion of its production and its technology portfolio

Metrika buys machinery business Robor

This is the second deal made by Metrika I fund, which targets Italian companies generating revenues of €20-100m

Capza exits Ivnosys to PSG-backed Signaturit

Sale ends a two-year holding period for Capza, which acquired a 40% stake in the business via Capzanine 4 Flex Equity

Alantra appoints two new operating partners

In their new roles, they will support the investment team in the management of Alantra's portfolio companies

Alto-backed CEI buys Lema

Combined group expects to reach revenues of €85m in 2021, with a 20% EBITDA margin

Clessidra's Botter bolts on Mondodelvino

Combined group expects to reach revenues of €350m in 2020 and further expand its market share

MBO exits public relations specialist LLYC

Sale ends a six-year holding period for MBO, which invested €6.35m in the business in exchange for a minority stake

Digital Alpha Fund II closes on $1bn

Fund invests in digital assets, with a focus on next-gen networks, cloud computing and "smart cities"