Southern Europe

Panakes to launch €120m second fund within months

VC expects to start raising capital by the end of the year and hold a first close in H1 2021

Aksìa backs machinery manufacturer Vomm

Third acquisition made by Aksìa Capital V, following its investments in Primo and Valpizza

Euregio Plus to launch €50m VC fund

Fund intends to support the growth and expansion of startups and SMEs

Base10, Cathay in $12m series-A for Lana

French venture capital house Cathay Innovation and Spanish ride-sharing company Cabify take part in the round

Oxy Capital exits Prio Energy to trade

Sale ends a seven-year holding period for Oxy Capital, which acquired the company from Martifer

Q2 Barometer: Coronavirus ravages European M&A market

After the first effects of the Covid-19 crisis were felt in March, the European private equity market decelerated sharply in Q2

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

HSBC Vision Private Equity 2020 closes on $260m

Fund targets a variety of private equity opportunities, from primaries and secondaries to direct co-investments

Vallis Capital sells Vortal to Stirling Square's Docu Nordic

Stirling Square intends to support Vortal in expanding its business in current and new markets

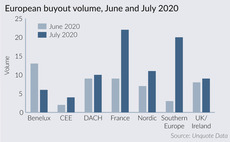

Southern Europe bounces back amid pandemic uncertainty

Southern European market has regained vigour and confidence in July following a catastrophic H1

OakNorth Bank provides fund facility to BlueGem

Key investors include Glendower Capital, Blackstone's Strategic Partners and BMO Global Asset Management

Bullnet Capital sells Codice SW to PE-backed Unity

Sale ends an 11-year holding period for Spanish venture capital firm Bullnet Capital

Guidepost injects $20m into Elements Global Services

Deal is the first investment from Guidepost's third fund, which came to market last year

Deutsche Beteiligungs buys PM Plastic Materials

First MBO in Italy for the GP, which will now start investing from its recently raised Fund VIII

Moira invests in Voovio Technologies

Company plans to use the fresh capital to expand its US operations and further develop its cloud services

Clessidra to buy wine producer Botter

Clessidra has been in negotiations for the acquisition of the Italian wine producer since February 2020

MCH buys pipes manufacturer Molecor

This is the second deal inked by MCH Iberian Capital Fund V, which recently held a €200m first close

GED invests in SimpleCloud via Conexo Ventures

SimpleCloud plans to use the fresh capital to accelerate its international expansion, primarily in the US

P101 in €6.4m round for WeSchool

CDP Venture and Tim Ventures take part in the round, alongside Club Digital and Club Italia Investimenti 2

Nuo Capital, Olma in €4.5m round for Artemest

Early-stage investor Italian Angels for Growth and Swiss holding company Brahma also take part in the round

Panakes et al. in €20m series-B for InnovHeart

Indaco Venture and CDP Venture Capital also take part in the round, alongside previous backer Genextra

France, southern Europe drive dealflow uptick in July

Buyout market is picking up again following one of the worst slumps on record, with some of the regions originally hardest hit becoming busier

ICG launches second recovery fund

Second vehicle will be larger than its predecessor, which closed on тЌ843m in March 2010

Astorg sells Surfaces Group to TA Associates

Sale ends a three-year holding period for Astorg, which acquired a 75% stake in the company from Xenon PE