UK / Ireland

Synova backs National Education Group

Investment in the education-sector online training and development provider is the GPs sixth deal from Synova IV

Bowmark fully exits Aston Lark in Howden sale

GP supported the MBO of Aston Scott in 2015, adding on Lark Group two years later

Social concerns increasingly important in European consumer M&A

Ethical supply chains, modern slavery, diversity and inclusion, wage gaps, and health and safety are all "potential liabilities" for M&A sponsors

Burger King UK owners mull GBP 600m listing – report

IPO plans are thought likely to be formalised within days, dual-track process could be explored too

European ESG market to hit EUR 1.2trn by 2025 – survey

Segment could account for between 27% and 42% of private markets' asset base, up from 15% in 2020, says PwC

Spotlight on Spacs: Fintech fever

A sustained surge in fintech deal-making may well have Spacs to thank

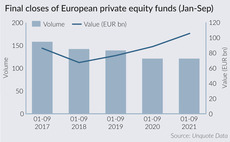

European GPs raise record amounts in first nine months of 2021

Raising EUR 105.5bn in aggregate commitments is a 30% increase on the average amount raised in comparable periods over the previous four years

ECI sells CPOMS to PE-backed Raptor

ECI bought the educational safeguarding software in 2018, investing via its GBP 500m ECI 10 fund

LDC sells Mandata to Tenzing

LDC acquired the transport and logistics software developer in a GBP 20m SBO from Synova in 2018

European buyout dealflow up 36% year-on-year in Q3

Europe was home to 346 buyouts worth an aggregate EUR 69.8bn in the third quarter, preliminary figures indicate

CFC Underwriting attracts Blackstone Group and OTPP

A deal could value CFC at an EBITDA multiple in the high teens or north of 20x

Women in PE continue to earn less than male counterparts – survey

Survey by Heidrick & Struggles found that female principals in the UK are an exception to the trend

British Private Equity Awards 2021: winners announced

Congratulations to the winners of this year's British Private Equity Awards, announced last night in London

European PE activity could reach EUR 400bn mark in 2021

Aggregate value for 2021 to date is already higher than that seen in any full-year on record, with a full quarter still to play out

Advent's Williams Lea in advanced sale process

Williams Lea is expected to generate EBITDA of EUR 39.5m in 2021

Five Seasons closes second fund on EUR 180m

Food-technology-focused VC held a final close for its debut fund on EUR 77m in 2019

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Inflexion hires Pagnotta as partner

Isabelle Pagnotta joins from her previous role as managing director at Omers Private Equity

Fund financing and ESG: from the impact niche to the mainstream

ESG-linked fund financing facilities are becoming a prominent т and well publicised т tool in the ESG toolbox for GPs and lenders

GP Bullhound closes Fund V on EUR 300m

Technology-focused firm's predecessor vehicle held a final close in June 2019 on EUR 113m

SGT, Tyrus announce strategic partnership

Collaboration will focus on capital markets-related PE deals in the US and Europe

Inflexion buys Detectortesters

Fire detection systems testing company has simultaneously acquired a US-based distribution partner

European IPOs reach seven-year high in first nine months of 2021

Sponsors have been on the ball when it comes to capitalising on the IPO window this year, according to Dealogic data

Tenzing hires Gottås ahead of Nordic expansion

Magnus GottУЅs will head the London-headquartered GP's sourcing of Nordic technology deals