UK / Ireland

IPEM 2023: GPs battle fundraising blues on the Côte d'Azur

Sponsors remain broadly optimistic despite fundraise bottlenecks and a growing number of LPs faced with tough choices on manager selection

Equistone to exit Acuity in sale to Permira

Sale of financial services research group follows process with early discussions between vendor and bidders

Bridgepoint picks advisers for Moneycorp upcoming sale

Goldman Sachs and Perella Weinberg hired for foreign exchange specialist's auction

The Bolt-Ons Digest – 26 January 2023

Unquote’s selection of the latest add-ons, with ICG's Circet, Five Arrows' Mintec, Carlyle's Jagex, and more

Travers Smith names new head of PE and financial sponsors group

Lucie Cawood's appointment follows poaching of Ian Shawyer by Cleary Gottlieb earlier this month

Q4 Barometer: deal count remains steady amid tough environment

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

Flight to quality, impact investing to drive allocations in 2023 – HarbourVest

Asset manager’s investment team discusses secondaries and co-investment dynamics amid a challenging fundraising market

Unquote Private Equity Podcast: The PE auction in times of exit scarcity

Rachel Lewis joins Harriet Matthews to discuss how auction process dynamics are changing against the current market backdrop

Arcano holds EUR 450m final close for latest secondaries fund

With just under 50% deployed, the vehicle will split focus evenly between LP stakes and GP-leds

Equistone to exit Bulgin to Infinite Electronics

UK sealed connectors manufacturer set to accelerate US expansion under trade owner

Accel-KKR weighs strategic options for Kerridge Commercial Systems

ERP software provider could seek a sale or bring in additional PE investor; Arma advises

Series A rounds likely bright spots in VC investing in Q1 2023 – KPMG

Energy security, ESG deals to continue apace, with consumer-focused businesses seeing most strain

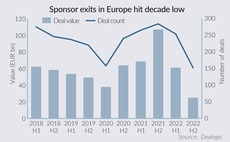

Going, going, not gone: PE auctions bid for relevance amid risk-off environment

With a debt financing drought and macro woes denting exits, GPs are adapting the traditional M&A auction in favour of more flexible bilateral negotiations to get deals across the line

Bellevue eyes Q1 2023 first close for debut secondaries fund

With USD 200m target, vehicle will primarily focus on USD 1m-30m LP stake deals

Imbiba holds GBP 70m first close on new growth fund

Leisure, lifestyle and entertainment vehicle has GBP 90m target; first investment completed

Partners Group sets fundraising guidance at USD 17bn-22bn

Private markets investor finished 2022 at the bottom of USD 22bn-26bn target for new commitments

Bridgepoint appoints advisers for Qualitest sale

JPMorgan and Jefferies will advise on an auction for the software testing group

Dyal raises USD 12.9bn for new fund with CVC, PAI stakes in portfolio

Blue Owl’s division exceeded target for fifth fund specialised in buying minority stakes in asset managers

Cleary Gottlieb hires Travers Smith's Shawyer for M&A practice

Ian Shawyer spent 17 years with Travers Smith and has worked on mandates for GPs including Bridgepoint

Gatemore eyes larger stakes in listed SMEs as path to take-privates

With its first closed-end fund in the making, the activist investor will use larger stakes to drive value creation and direct small-cap targets towards PE sales

Northedge sells majority stake in CTS to Marlin Equity

Deal for cloud infrastructure group marks partial exit for vendor, which will reinvest

VGC on the road for GBP 150m fund; appoints former Nike exec

Brands-focused firm eyes first close for new flagship vehicle in coming months; Dan Rookwood joins as head of brand

Blue Owl poised to revive Dyal IPO plan in H2 2023

Listing of GP stakes specialist could take place in London as early as September

Hamilton Lane raises USD 2.1bn for fifth co-investment fund

Close comes at a time when challenging credit and fundraising markets are increasing GPs’ need for strategic capital sources