UK / Ireland

Pamplona to liquidate LetterOne-backed funds, to sell LP stakes in cut-off process

GP to begin formal wind down process on three funds after sanctions hit the LP’s Russian backers

Livingbridge buys Nourish Care Systems

GP’s investment will aim to further develop the UK-based provider of digital care planning software to the social care sector

CVC’s Amsterdam IPO move adds impetus to calls for LSE reform

CVC Capital Partners’ reported preference for Amsterdam as a potential home for its shares shows that London’s regulatory regime still needs to be far more flexible, several sources said.

Circularity Capital hires new investment director

Deanna Zhang joins the UK-based circular economy investor from L-Gam

CD&R appoints European portfolio procurement director

Marta Benedek joins Clayton, Dubilier & Rice following a 20-year stint at General Electric

EMK Capital gears up for third fund

European mid-market investor held a final close for its predecessor fund in 2020 on EUR 1.5bn

Exponent sells Enra to Elliot Advisors

Exit reportedly values the UK-based specialist mortgage finance provider at more than GBP 350m

Limerston Capital buys Largo Leisure in first Fund II deal

Deal also marks the new fund’s first closing; GP to seek bolt-ons for the Scotland-based holiday park operator

Aztec Group appoints new chair to board

Kathryn Purves to succeed Patrick Gale as new board chair from 1 April

GP Profile: 17Capital eyes buoyant NAV financing market

Unquote speaks to managing partner Pierre-Antoine de Selancy about the GP's strategy and market view

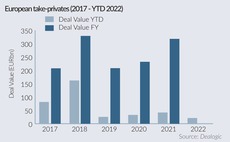

Turning to powder: European take-privates take pause

Public to private transactions are off to a slow start this year but lower prices on stock markets could encourage dealmaking again

Palatine buys significant minority stake in Cura Terrae

GP becomes the single largest shareholder in the newly created UK-based environmental services group

Apax leads GBP 175m round for ClearBank

Clearing and embedded banking platform is the first deal from the GP’s USD 1.75bn Apax Digital II

Clearlake, Motive to acquire BETA+ from LSEG for USD 1.1bn

GPs will use wealth management processing solutions provider as a buy-and-build platform and enter new high growth markets

GHO to explore Sterling Pharma exit this year

UK pharma manufacturing services asset could be marketed off GBP 50m EBITDA in a sale process in H2 2022

One Peak gears up for fund III

European growth technology firm held a final close for One Peak Growth II in 2020 on EUR 443m

Bowmark explores Lawyers On Demand exit

GP appointed Rothschild to advise on the sale process, which is still in its early stages

The Bolt-ons Digest – 18 March 2022

KKR’S Biosynth Carbosynth, Agilitas’ Cibicom, Apax’s Graitec, Cairngorm's Verso, Altor's Trioworld, and more

WestBridge acquires Smart Capital Technology in MBO

GP invests GBP 17m following competitive auctions for IT services organisation company

Boots sale stumbles against limited financing availability

Asda and sponsors Apollo and Sycamore are said to be circling the auction of the Walgreens Boots Alliance-owned business

BEX Capital raises USD 765m for Fund IV

Secondaries fund-of-funds remains open for no-fee, no-carry investments from NGOs and non-profits

Capital D-led consortium acquires Phrasee

GP is joined by Morgan Stanley Expansion Capital, Keyhaven Capital, family offices in deal for AI-power copywriting group

Motive sells Global Shares to JP Morgan

Deal generates around 10x return on invested capital and values the Irish equity compensation software solutions at USD 750m EV

Gilde Healthcare closes fourth buyout fund on EUR 517m

Double the size of its predecessor, the new vehicle was oversubscribed and saw nearly all Gilde’s existing LPs investing