UK / Ireland

SEP sells ControlCircle to Alternative Networks

Scottish Equity Partners (SEP) has sold hosting and cloud-based services provider ControlCircle to Alternative Networks for £39.4m.

LDC buys Bluestone

LDC has acquired a significant stake in financial services business Bluestone Group.

Balderton leads $7m round for GoCardless

Balderton Capital has led a $7m series-B round for GoCardless, a London-based B2B online direct debit platform, alongside existing backers Accel Partners and Passion Capital.

Premier Foods toasts Hovis sale

Warburg Pincus-backed Premier Foods has sold its bread business, Hovis, to US private equity firm The Gores Group in a deal valuing the division at £87.5m.

Warburg Pincus hires Kukielski as new EIR

Peter Kukielski, Warburg Pincus

Carlyle indulges with Lily O’Brien’s

Carlyle’s Ireland-focused fund has invested in premium chocolate and dessert maker Lily O’Brien’s.

Braveheart and Crowdcube set up crowdfunding co-investment fund

Braveheart Investment Group and crowdfunding platform Crowdcube Ventures have established the Crowdcube Venture Fund (CVF), a co-investment vehicle for crowdfunded businesses.

Agilitas invests in Impetus Waste Management

Pan-European investor Agilitas has supported the management buyout of Impetus Waste Management.

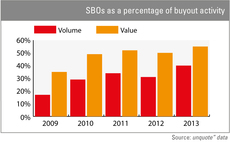

SBOs hit new peak in 2013

Secondary buyouts rose to new levels of prominence in the European market last year, accounting for 40% of all buyouts and 55% of aggregate buyout value. Greg Gille reports

Highland leads €23.5m investment in AMCS

Highland Capital Partners Europe has led a €23.5m capital injection into AMCS Group.

Cerea and BPI France carve out Chesapeake division

Agribusiness-focused Cerea Partenaire and French state-backed BPI France have acquired the speciality chemical packaging division of Chesapeake.

NPRF offloads €800m PE portfolio to Lexington

The National Pensions Reserve Fund of Ireland (NPRF) has sold around €800m of global private equity fund interests to secondaries firm Lexington Partners.

Index injects $21m into The Cambridge Satchel Company

Index Ventures has invested $21m in satchel maker The Cambridge Satchel Company.

HgCapital becomes fifth PE backer of Zenith

HgCapital has acquired car rental company Zenith Vehicle Contracts Group from Morgan Stanley Global Private Equity (MSPE).

VC-backed Egalet files $45.5m IPO

UK-based pharma company Egalet, backed by a consortium of venture capital firms, is seeking to raise up to $45.5m in its IPO on the Nasdaq.

Sovereign’s Cordium picks up HedgeStart

Sovereign Capital has backed Cordium’s acquisition of HedgeStart as it continues its buy-and-build growth strategy.

North West Fund backs BMWQ

The North West Fund for Digital and Creative, managed by AXM Venture Capital, has invested in BeatMyWasteQuote.com (BMWQ), a UK-based B2B online switching platform for waste disposal services.

Placement agents: a dying breed?

The placement agent industry has attracted criticism of late, with some labelling it as nothing more than a glorified introductory business. As fundraising becomes more complex, Alice Murray investigates how relevant this advisory service is

Balderton et al. invest $14m in Lyst

Balderton Capital has led a $14m series-B funding round, alongside existing backers DFJ Esprit and Accel Partners, for Lyst, a London-based fashion e-commerce site.

BDO appoints Gouldstone to pharma team

BDO has appointed Martin Gouldstone as a director within its pharmaceutical-focused corporate finance team in London.

Vision’s Cortas promoted to partner

London- and New York-based private equity firm Vision Capital has promoted Samer Cortas to partner.

Apax takes full control of Trader Media

Apax Partners has acquired a further 50.1% stake in Guardian Media Group’s (GMG) Trader Media Group (TMG), securing full control of the company.

Nesta Impact fund deploys £2m in first investments

Nesta Investment Management has made its first social impact investments, deploying £2m across four businesses.