UK / Ireland

UK consumer sector exits at record levels

The number of UK consumer goods assets divested by private equity firms is at its highest level in 10 years despite the continued desolation suffered by the consumer market.

VC-backed Just-Eat hints at future IPO

Online food delivery service Just-Eat, which is backed by a number of venture capital firms, has confirmed its plans to list on the stock market in the future.

Redpoint leads $7m round for Moogsoft

Redpoint Ventures has led a $7m series-A funding round for London-based service management software company Moogsoft.

BGF invests £6m in Petrotechnics

The Business Growth Fund (BGF) has backed Aberdeen-based Petrotechnics, a provider of software solutions for risk management in hazardous industries, with a £6m investment.

Beringea exits Fjord

Beringea has sold service design consultancy Fjord to management technology outsourcing and consulting service provider Accenture Interactive.

Graphite sells Dominion Gas to Praxair

Graphite Capital has sold Aberdeen-based oil field services company Dominion Gas to NYSE-listed Praxair.

Metastudy: Private equity drives innovation and growth

A new secondary research report has found that private equity investing leads to increased foreign investment and improvements in innovation.

FF&P appoints Joy as senior adviser

International wealth manager Fleming Family & Partners (FF&P) has appointed Andrew Joy as a senior adviser.

Catapult makes follow-up investment in RTS

The Catapult Growth Fund has made a follow-up investment into wind turbine service provider Renewable Technical Services (RTS).

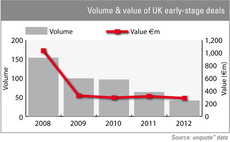

Value of UK early-stage investments holds steady

UK early-stage deal numbers are dropping off, but the total value invested has held steady over the last four years.

Fountain Healthcare backs €9.2m Trino Therapeutics round

Fountain Healthcare Partners has invested in a €9.2m series-A funding round for Ireland-based Trino Therapeutics Ltd, alongside British grant-giving body Wellcome Trust.

PineBridge's Calo joins Blackstone’s Park Hill

Blackstone's placement agent division Park Hill Group has appointed Pablo Calo from PineBridge Investments.

Octopus leads £2.95m investment in Conversocial

Octopus has led a £2.95m investment round for social media management software company Conversocial.

Equistone reviews options for Allied Glass

Equistone has hired Rothschild to assess its options for Allied Glass, which could result in a sale later on this year.

LDC backs MBO of Node4

LDC has backed the management buyout of UK-based IT and communications services provider Node4 Ltd.

Private equity tempted by Hotel Chocolat

Private equity houses are in talks with confectioner Hotel Chocolat regarding a possible purchase, which could see the company valued at around £100m.

British Gas leads £7m investment in 4energy

British Gas has led a £7m investment in 4energy alongside existing investors Environmental Technologies Fund (ETF), Carbon Trust Investments and Catapult Venture Managers.

ACT et al. invest $5.2m in Cubic Telecom

ACT Venture Capital, Enterprise Ireland, TPS Investments and US telecoms giant Qualcomm have jointly invested $5.2m in Dublin-based global connectivity specialist Cubic Telecom.

3i to buy Barclays’ infrastructure fund management business

3i has made a binding offer to buy Barclays’ European infrastructure fund management business.

The importance of being European

EU membership

EU postpones Solvency II rules on pensions

The European Commission has postponed a bid to apply Solvency II style rules to pension funds as part of the revised IORP Directive.

Blackstone, Carlyle targeted by Stop G8 protests

Anti-capitalism protest group Stop G8 has publicised the London addresses of several private equity firms – including Blackstone, Carlyle and Lion Capital – ahead of the G8 Summit in June.

Maven, Connection reap 1.8x on Atlantic Foods sale

Maven Capital Partners and Connection Capital have sold their stake in Atlantic Foods Group to Flagship Food Group LLC, a US trade buyer.

Ares hires former Blair adviser

Ares Management has appointed former Tony Blair adviser Charles Steel as managing director, heading up the fund's European private equity operations.