Sector

Ekkio backs Mediliant

Mediliant is the fourth investment completed via Ekkio Capital IV, closed in May 2018

Bregal Milestone backs Italian gift cards provider Epipoli

GP deploys capital from its €400m vehicle, which held a final close in July 2018

Stirling Square buys Logent from Adelis

Second platform investment from Stirling Square Capital Partners IV, which is targeting тЌ800m

Ardian acquires Sintetica

In 2018, Sintetica reported revenues of CHF 75m, up from approximately CHF 60m in 2017

Palatine supports MBO of Lucion Services

Testing, inspection and certification business will undertake an acquisitive growth strategy

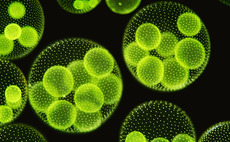

TA Associates' Solabia Group buys Algatech

TA has been a minority investor in natural active ingredients manufacturer Solabia since 2018

ArchiMed carves out Diesse from PZ Cormay

Diesse was acquired from Orphée, the Swiss subsidiary of Warsaw-listed diagnostics group PZ Cormay

LDC sells Away Resorts to Bregal Freshstream

Deal is the 10th investment made by Freshstream's debut fund, which writes cheques of тЌ30-100m

Towerbrook exits Metallo in €380m deal

Sale ends a six-year holding period for the GP, which bought the company from Groupe Alpha

Tengram sells This Works for £43m to Canopy Growth

Canopy Growth focuses on the production of cannabis products for medical and recreational uses

BM-T exits Hasec in trade sale

Scanfil has wholly acquired Hasec for €10.25m worth of Scanfil shares and liquid assets

Horizon sells Eat to Pret a Manger

Sale of UK sandwich shop chain brings to an end an eight-year holding period for the vendor

Triton-backed Unica buys Brainpact

Triton acquired industrial technology and process management group Unica in 2017

Sofinnova closes MD Start III Fund on €48m

MD Start, which is a group of three funds, was started by Sofinnova Partners in 2010

Baird Capital exits Clearwater in £11m deal

Sale ends a four-year holding period for the GP, which bought the company via its BCPE Fund II

Assietta backs cosmetics specialist Effegilab

GP invests in the company by deploying capital from its APE III fund, closed on €48m in 2015

YFM invests $4.5m in Elucidat

Education-focused authoring platform developer will invest in product development and recruitment

123 IM, Sigma Gestion back L'Usine

GPs acquire a majority stake, investing €4m in the France-based high-end gym operator, L'Usine

VC firms back €12m series-A for Kodit.io

Firm has recently launched in Madrid and plans to expand to Paris, Barcelona and Warsaw this year

Maven invests in WaterBear Education

Maven is currently investing from its Maven UK Regional Buyout Fund, which closed on тЌ100m

KKR's Trainline announces intention to float

Train and coach ticket booking company expects to be eligible for FTSE inclusion following IPO

DMH acquires WT Systems

WT Systems filed for insolvency in February 2019 and Scultze & Braun was appointed administrator

Montagu sells Covidence to EMK

Sale ends a four-year holding for the GP, which acquired the company using capital from Montagu V

One Peak Partners et al. invest €15m in Quentic

One Peak Partners and Morgan Stanley Expansion Capital invested €22m in Quentic in 2017