Sector

Andera et al. back Dynacure in €47m round

Investors support the biotech business in advancing its lead programme into clinical development

Redalpine and Swisscom sell Bexio to Mobiliar

Sale of the enterprise software company generates returns for Redalpine Capital II

Partners Group buys Megadyne in SBO

Company's founders, the Tadolini family, reinvested in the business alongside Partners Group

Opera-backed Vetrerie Riunite sells Technoglas to Cerve

Acquirer will invest up to €30m in the production facilities in Austria, according to Italian press

Auriga Partners leads €7m series-A for Nextbiotix

New funding will be used to support efforts in bringing new medicine to patients

Raise to back Artemis Courtage

Raise Investissement typically invests €10-50m in companies generating a €30-500m turnover

Idinvest leads $17m series-B for 21Buttons

Latest round brings total funding to $31m, and will be used to expand into the US market

CapMan sells InfoCare

Transaction ends a 13-year holding period for the Helsinki-headquartered private equity house

Oakley sells Damovo to Eli for up to €140m

Sale of the IT business will generate a 5.4x return for the vendor, equivalent to a 57% IRR

Afinum sells Orwo Net

Sale ends a seven-year holding period for Afinum, which acquired a minority stake in 2011

HTGF, ECapital invest €4.6m in FMC

Round is closed just nine months after HTGF backed a seed round for the business

Hivest buys St Mamet in SBO

Florac sells stake in canned fruits specialist Saint Mamet having invested in 2015

NB Renaissance acquires Uteco

Uteco Group's management team and current majority shareholders will retain stakes of 9% and 10%

Attestor Capital makes €200m offer for Condotte

Troubled Italian construction firm will enter administration unless an agreement is reached quickly

Chevrillon & Associés buys DCW Editions

Chevrillon provides equity tickets in the €5-75m range for businesses valued at between €200-250m

Madison Dearborn and HPS acquire UK insurance firm PFP

US private equity houses own Ardonagh, a group of UK-based insurance brokers

Waterland acquires Helgstrand Dressage

Deal marks Waterland's first investment in Denmark after the opening of its office in Copenhagen

VC firms back $20m series-C for Fever

Round is co-led by Spanish media company Atresmedia and technology real-estate business Labtech

Investindustrial buys Dispensa Emilia

Third acquisition from Investindustrial Growth, which hit its €375m hard-cap in May

Cinven's Chryso buys Ruredil

Chryso, a producer of additives for concrete and cement, buys assets from Italy-based Ruredil

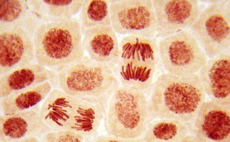

NVM leads £2m round for Newcells Biotech

NVM provides ТЃ1.5m towards the round, while Northstar contributes the remaining ТЃ500,000

MBO Partenaires backs Laboratoires Embryolisse

French GP provides a €16m ticket for the transaction, which values Embryolisse at between €50-100m

Quantum Capital Partners exits Barcelona Cartonboard

Group is sold to Italian trade buyer Reno de Medici after a three-year holding period

RCapital acquires Havelock from administrators

Acquisition of shopfitting company will safeguard 300 jobs and Havelock's manufacturing sites