Sector

EQT partially divests EIS Aircraft Group

EQT remains invested in the EIS Aircraft Products and Services division

Bocap invests €6m in Eficode

Eficode plans on speeding up its international expansion plans with the fresh funding

IK buys Bahr Modultechnik

GP draws equity from IK Small Cap II, a €550m fund that held a final close in February 2018

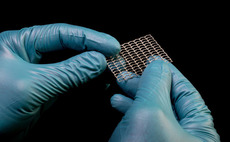

LDC acquires Precision Micro in £22.5m MBO

Deal sees the GP invest ТЃ13m in the Erdington-based photochemical etching company

Naxicap exits Paradis du Fruit

GP sells its minority stake in the French restaurants operator to the management team

Synova's Stackhouse Poland bolts on Honour Point

Acquisition of corporate insurance broker and risk management firm is Stackhouse's ninth bolt-on

Accent Equity sells Stål & Hyr in trade deal

Deal comes only a year after Accent Equity purchased a majority stake in the business

Index leads $5m series-A for ClauseMatch

Talis Capital joins the round alongside existing investors including Speedinvest

Hg sells Allocate Software to Vista

Healthcare workforce management software company has expanded internationally under Hg's tenure

Index Ventures et al. back Slite

Consortium of backers invest €3.7m in the French note-taking app developer

Mobeus backs Hemmels

Fresh capital will be used to scale up the company's engineering and research and development teams

Inflexion acquires EHL, UKWM, creates Comparison Technologies

New multi-channel price comparison company is likely to pursue bolt-on acquisitions

Bowmark, Abry reportedly in second round for LDC's PEI Media

Initial bids for the company, submitted last month, came in at more than 10x EBITDA

CVC sells Sky Betting & Gaming in $4.7bn deal

CVC acquired SBG in 2014, in a deal valuing the online betting and gaming company at ТЃ800m

GTCR sells CallCredit to TransUnion for £1bn

Sale comes four years after the GP acquired the credit reference bureau for around ТЃ480m

Mangrove leads €3.2m series-A for Adverity

Existing investors Speedinvest, 42Cap and AWS Gründerfonds also take part in the round

Rutland divests Pizza Hut in management buy-back

GP will retain a minority stake in the UK pizza restaurant chain following the deal

Fondo Italiano invests €10m in Seco

Computer components company will seek to pursue international expansion and make bolt-on deals

Sofinnova leads €35.5m capital increase for Inventiva

Capital is drawn from Sofinnova Crossover Fund I, which held a final close on €275m in April 2018

Paragon-backed Chicco di Caffè buys Bota Group

Selling shareholders Pius Widmer and Bruno Wanske exit to pursue other opportunities

LDC's LearnDirect divests e-assessment division to PSI

Sale comes eight months after the company lost an appeal against an "inadequate" Ofsted rating

CVC, EQT Credit in second refinancing round for Paymentsense

Debt package follows a first refinancing deal in November 2016 by the debt providers

Keensight-backed Pixid buys Carerix

Keensight invested in Pixid, a French online management system for temporary work, in 2015

IK sells Touristry in trade deal

Deal ends a two-year holding period for IK, which acquired the business via its IK Small Cap I Fund