Sector

Idinvest et al. in $25m series-B for Onfido

Automated background checking firm is to expand in the US after its rival's recent $40m round

Forbion closes third fund on $208m

The VC has bolstered its Munich-based team hiring Matthias Falcenberg as an analyst

Capricorn et al. back €10m series-B for iStar

The funding will help iStar finalise the development of its current product MINIject

Ardian in exclusive talks with IK to acquire Trigo Group

Parisian GP is looking to acquire IK's majority stake in the target group

Innova Capital backs Netsprint

2010 Unquote" Private Equity Awards CEE Fund of the Year winner leads growth round for adtech business

Altor takes 25% stake in Skandiabanken for NOK 1.2bn

The deal is a continuation of Altorтs ongoing strategy of public minority investments

Vaaka-backed Enegia buys intStream

Energy-market-focused software company will be the first bolt-on for Enegia since Vaakaтs 2014 buyout

Finatem sells WST Präzisionstechnik to Cathay Capital

Finatem acquired the company in 2012

Foresight injects growth capital into Peekaboo

UK nursery group will expand through bolt-on acquisitions and new sites

Phoenix backs £30m buyout of Travel Chapter

Deal for accommodation booking company marks the maiden investment for the GP's fourth fund

Warburg in £230m Reiss deal

Warburg will support Reiss's continued international expansion following the deal

CapMan exits Suomen Lämpöikkuna to Inwido

Inwidoтs bolt-on is the first acquisition for the company after Swedish GP Ratos's full exit

Enterprise Investors sells 17.3% of PBKM ahead of Warsaw IPO

Trading of shares in the Polish stem-cell bank will begin on April 28 on the Warsaw stock exchange

Livingbridge invests in Direct Ferries

Deal for the online ticket aggregator marks Livingbridge's 100th investment to date

Spring Ventures invests £20m in BIMBO of IGF

Provider of SME financing will undertake a recruitment drive and expand across the UK

Herkules makes 3.5x on Micro Matic exit

Norwegian private equity firm exits nearly a decade after acquiring the systems maker

Inveready leads €1m round for Datumize

Backers of the data analysis business include Caixa Capital Risc and several business angels

PE-backed Italian Design Brands buys Meridiani

Private Equity Partners-backed Italian Design Brands scores its first bolt-on acquisition

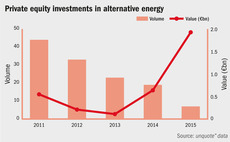

Private equity continues to shy away from renewables

Declining dealflow confirms the industry's move away from alternative energy, despite two large deals inked in 2015

Tiller Systems raises €4m from 360 Capital et al.

The fresh capital should allow the French tech company to expand its team significantly

Project A backs Junomedical's seed round

Project A backs medical tourism startup Junomedical, which operates in six countries

Investindustrial acquires Artsana

Investindustrial VI completes first transaction after final close on €2bn hard-cap

Endeit and Beringea in $25m series-B for Blis

London adtech company is to expand into the US market and invest in marketing activity

Invision sells RSD to Argos Soditic

Invision sells Swiss software company RSD to Argos after acquiring it in 2007