Sector

ESG concerns limit bidders in LMB Aerospace sale

First-round bids for France-based LMB Aerospace were collected last week

Carlyle's tech fund buys majority stake in CSS

Deal should see Carlyle Europe Technology Partners IV moving closer to full deployment

ArchiMed's MED II fund fully invested following Cube buyout

Cube is the last platform investment for the MED II fund, which closed in 2017

Apax, Warburg Pincus consider exiting Inmarsat – report

Shareholders could also think about listing Inmarsat, according to sources in the Bloomberg report

Carton Pack attracts Chequers, Clessidra, A&M Capital Europe

21 Invest has hired Vitale&Co and William Blair to guide it in the sale

HealthCap looks to future growth after new appointments

Venture capital firm HealthCap is looking ahead to a busy healthcare and life sciences market

eEquity reaps 15x on sale of PriceRunner to Klarna

Deal values PriceRunner at more than SEK 9bn, allowing eEquity to exit in less than two years

BC Partners uses special-purpose fund to back Pet City in Greece

BC Partners GR Investment is set up to invest in high-growth SMEs in Greece

GHO appoints new director of sustainable investing

GHO creates the new role in order to further institutionalise its commitment to ESG

Insight Partners leads USD 125m Series C for Moonfare

Moonfare exceeded EUR 1bn in assets under management in September

Marlin Equity readies Collenda for auction

Raymond James is advising on the process, which could kick off before year-end

LBO France, PAI in second round for Alliance Marine

Alliance Marine went on a bolt-on shopping spree under Weinberg ownership

Nauta closes fifth fund on EUR 190m

Fund was launched in December 2019 and went on to hold a first close in July 2020 on EUR 120m

Aurelius buys McKesson UK in GBP 477m deal

Carve-out of McKesson UK includes LloydsPharmacy and is Aurelius's largest deal to date

Consumer dealflow rebounds strongly in Q3

More on-trend verticals such as technology and healthcare took a backseat in the third quarter, Unquote Data shows

Palatine sells Estio to PE-backed BPP

Deal is the first exit from Palatine's first Impact Investing fund, which closed in 2017 on GBP 100m

Procuritas backs Strandberg Guitars

GP is backing the headless guitars producer via its EUR 318m Capital Investors VI fund

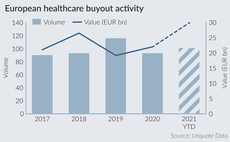

Healthcare buyouts approach record EUR 30bn in 2021

France has been the source of more than half of the aggregate value recorded to date

Anaveo sale pulled despite late-stage talks with 3i

Competitive process stalls as vendor Bridgepoint's price expectations were not met, sources say

ECSO on lookout for LPs for EUR 1bn cybersecurity platform

ECSO aims to raise EUR 1bn by the third quarter of 2022, with the platform structured as a fund-of-funds

Carlyle gears up for next Europe Technology Partners fund

GP registers several Carlyle Europe Technology Partners V vehicles, with the most recent fund having closed in 2018

IK invests in Prophecy Group

Minority investment in the cybersecurity firm is IK's sixth deal to be announced in H2 2021

3i scores 47% IRR on Magnitude sale

Sale to US trade player Insightsoftware generates proceeds of USD 477m

IK Partners buys Plastiflex

GP is investing via its EUR 1.2bn Small Cap III fund, which backs companies valued at EUR 15m-150m