Support services

Régie Linge Développement sale process stalled

The sale process of Sagard-owned Régie Linge Développement (RLD), a French business specialising in the rental and laundering of work wear, has reportedly stalled over debt concerns.

Dunedin's CitySprint buys Eagle Express

CitySprint, a distribution network backed by Dunedin, has acquired Eagle Express Worldwide Couriers.

ICG invests in Viking

Intermediate Capital Group has made a minority investment in Norwegian roadside assistance provider Viking Redningstjeneste.

PE-backed Walter Services buys Perry & Knorr

HIG Europe and Anchorage Capital portfolio company Walter Services has taken over German customer care business Perry & Knorr.

Industrifonden et al. invest in Avtal24

Industrifonden along with private investors Richard BУЅge, Magnus Wilkne, among others, are investing SEK 10m in Swedish online legal services provider Avtal24.

Activa Capital's Ergalis makes bolt-on acquisition

Activa Capital portfolio company Ergalis has acquired French temporary employment and recruitment agency Aura Staffing from Segula Technologies.

Baird buys The SR Group

UK-based mid-cap investor Baird Capital Partners Europe has invested in The SR Group, a recruitment services firm.

MML Capital exits MineTech

MML Capital Partners has sold its 40% stake in UK-based landmine clearance company MineTech to German trade buyer Dynasafe Area Clearance Group, which is backed by Perusa Partners.

Cabiedes & Partners leads funding round for Floqq

Cabiedes & Partners has led a €405,000 funding round for Madrid-based Floqq, an online education platform designed for those seeking employment.

ICG backs MBO of ATPI from Equistone

The management team of UK-based travel management business ATPI has bought the company from Equistone with support from ICG.

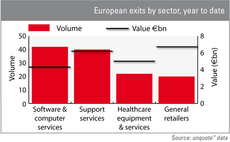

Software and retail lead 2012 exit league

General retailers and software & computer services lead the exit rankings for 2012.

Montagu and GIP exit Biffa via debt-for-equity swap

Montagu Private Equity and Global Infrastructure Partners (GIP) have exited UK waste services company Biffa via a debt-for-equity swap with the company's senior lenders.

Dunedin reaps 3x money multiple on etc venues exit

Dunedin Capital Partners has exited UK-based conference and training venues business etc venues in an SBO to Growth Capital Partners (GCP), reaping a 3x money multiple on its original investment.

CT Investment Partners et al. back Cable-Sense

CT Investment Partners' North West Fund for Energy & Environmental and MTI Partners' UMIP Premier Fund have backed UK-based infrastructure management company Cable-Sense with ТЃ800,000.

DBAG acquires Heytex Bramsche from NORD Holding

Deutsche Beteiligungs AG (DBAG) has acquired Heytex Bramsche, a German manufacturer of print media and technical textiles, in an SBO from NORD Holding.

Nazca buys Ovelar for €28m

Spanish GP Nazca Capital has wholly acquired visual merchandising company Ovelar Merchandising for €28m.

Highlander buys ProService AT from Enterprise Investors

Highlander Partners has acquired Polish transfer agent ProService Agent Transferowy from Skarbiec Holding, a portfolio company of Enterprise Investors.

Elbrus Capital invests in SPSR-Express

Elbrus Capital has taken a stake in Russian delivery business SPSR-Express, leading to a partial exit of the Russian Retail Growth Fund.

NVM exits Paladin Group

NVM Private Equity has exited its stake in UK-based property services company Paladin Group to trade player Places for People in a deal worth ТЃ15.9m, reaping a 2.3x return on its investment.

CBPE buys Xafinity Consulting

CBPE Capital has carved British pensions consultancy firm Xafinity Consulting out from Advent International-owned Equiniti Group.

MMC's Base79 gets equity injection from Chernin

British online video company Base79 has received a $10m equity investment from US media company Chernin Group, on top of additional funding from existing backer MMC Ventures.

AEA and Teachers' Private Capital buy Dematic from Triton

AEA Investors and Teachers' Private Capital, the private equity arm of the Canadian Teachers Pension Plan, have bought German logistics business Dematic in an SBO from Triton.

Waterland backs creation of Fleetpro

Waterland Private Equity has backed the merger of River Advice and International Shipping Partners by taking a majority stake in newco Fleetpro, a ship management company headquartered in Switzerland.

Hamilton Bradshaw backs MBO of SF Group

Hamilton Bradshaw Private Equity has provided capital to support the management buyout of financial recruitment firm SF Group.