DACH VC deal value doubles year on year

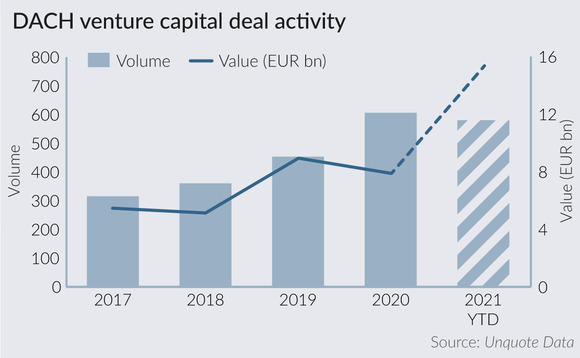

The aggregate value of venture and growth capital deals in the DACH region has reached almost EUR 15.4bn in 2021 to date, nearly double the EUR 7.9bn invested in 2020, according to preliminary figures from Unquote Data.

Although 2021's 580 VC deals have not yet exceeded the record deal volume high of 606 seen in 2020, with two and a half months left of the year, it looks likely that 2021 will also be a record year.

The high-value rounds recently raised by N26 and Gorillas have added almost USD 2bn to the total. Gorillas' latest round marks the second time in 2021 that the grocery delivery startup has raised a funding round of almost USD 1bn, capitalising on the e-commerce, and food and beverage delivery trends reinforced by the coronavirus pandemic.

Although larger rounds continue to draw the most attention, with deals becoming increasingly competitive, the market continues to be bolstered by earlier-stage activity; 81% of the deals recorded in 2021 were valued at less than EUR 25m, according to Unquote Data, although these deals made up just 17% (EUR 2.7bn) of the year's aggregate deal value to date.

This is reflected when reviewing the most active VC investors in the region, which include early-stage investors such as High-Tech Gründerfonds (34 deals), Bayern Kapital (16 deals) and Speedinvest (14 deals). However, international later-stage investors such as Insight Partners (10 deals) have also invested significantly in the region.

According to Unquote Data, 2021 has not yet been as strong a year for venture capital fundraising in the DACH region as 2020, in spite of strong deal activity. DACH-headquartered venture capital firms have raised EUR 956m across 12 first and final closes in 2021 to date, versus EUR 3.4bn raised across 25 first and final closes in 2020 in total. These included the EUR 535m final close of HV Capital Fund VIII, as well as the EUR 678m raised by Lakestar across Lakestar Growth I and Lakestar III.

In the European market as a whole, EUR 8.4bn has been raised across 71 first and final closes for venture capital vehicles in 2021, according to Unquote Data.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds