French mega-rounds shoot up in 2021

Recent mega-rounds for Sorare, Mirakl and Vestiaire Collective have added to an already rich year for French venture, according to Unquote Data.

Recent days have served as a good reminder that France's venture ecosystem is firing on all cylinders this year, and particularly when it comes to headline-grabbing mega-rounds of EUR 100m and above.

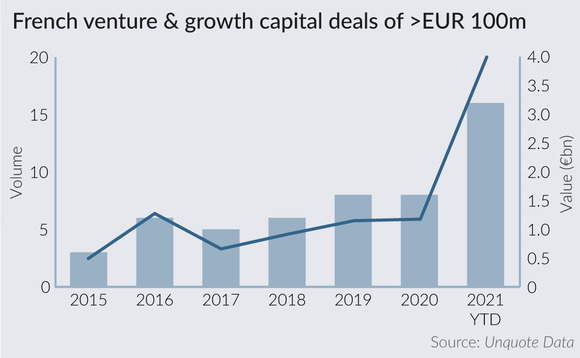

Unquote Data has recorded 16 early-stage and growth capital deals valued in excess of EUR 100m each so far this year, amounting to a total of EUR 3.99bn. This is double the volume of such rounds recorded for the whole of 2020, when the aggregate value of these deals stood at around EUR 1.2bn.

To look at it from a different perspective, French businesses have attracted as many mega-rounds – and not far off double the amount of capital – in the first nine months of 2021 than in 2019 and 2020 combined.

Just this week, fantasy football game developer Sorare announced it has raised USD 680m in a funding round led by Softbank, with the company claiming that the investment is Europe's largest ever Series B. The round also saw participation from Atomico, Bessemer Ventures, D1 Capital, Eurazeo, IVP and Liontree. They were joined by existing investors Benchmark, Accel and Headline, as well as business angels including football players Gerard Piqué, Antoine Griezmann, Rio Ferdinand and César Azpilicueta.

Mirakl, a developer of on-demand online marketplaces, also raised USD 555m in a Series E funding round, led by Silver Lake. Long-term backers 83North, Elaia Partners, Felix Capital, and Permira also took part in the round. The fresh funding increased the company's valuation to more than USD 3.5bn.

Meanwhile, French VC darling Vestiaire Collective – a secondhand fashion retail platform – has raised another EUR 178m, shortly after securing a similar round in March. SoftBank Vision Fund 2 led the round, with backing from Generation Investment Management, Eurazeo and Conde Nast.

It is not just the amounts raised by these businesses that are turning heads – the pace of increase in round sizes and valuations is also eye-watering. Mirakl's valuation has more than doubled since its USD 300m Series D just a year ago, from USD 1.5bn to USD 3.5bn. Vestaire reached unicorn status in March, and six months later is reportedly now worth in excess of USD 1.7bn.

As for Sorare – now worth USD 4.3bn – the Series B is 13.6 times larger than the USD 50m Series A raised by the business just seven months ago. The company was founded in 2019 and raised a comparatively meagre USD 4m seed round last summer.

These mega-rounds – with amounts that would have been unheard of just a few years ago – show that France's venture ecosystem has been able to nurture standout businesses able to scale at pace. But they also illustrate a potentially worrisome bifurcation in the market, similar to that seen in European venture as a whole, where a smaller number of startups attract the lion's share of capital pursuing VC opportunities in the country.

According to Unquote Data, the estimated amount raised across all venture and growth capital deals in France so far in 2021 has already reached an all-time high of around EUR 6.6bn – eclipsing 2020's full-year tally of EUR 4.9bn. But at the same time, fewer businesses have been targeted for investment: Unquote Data has recorded 197 deals so far this year, meaning it is highly unlikely that the full-year total will even match the 407 rounds seen in 2020.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds