Benelux Unquote

Waterland holds €2bn final close

Dutch buyout private equity firm closes its seventh fund two months after launching in July 2017

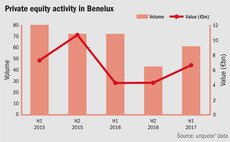

Benelux activity picks up in first half of 2017

Following a slow H2 in 2016, dealflow in the Benelux region is on the up with Belgium in particular seeing increasing activity

AlpInvest hires Bagijn as primaries business head

New managing director is joining from her previous role at Axa Investment Managers

Halder-backed Aqua Vital buys Kalimba

Acquisition solves a succession problem for the company's founders, who started the business in 1996

Mentha mulling Optimum sale

Mentha Capital took a majority stake in Optimum in 2014, investing from Mentha Capital Fund IV

Mentha Capital exits Venko Groep

Mentha sells the Dutch business to Clayton Dubilier & Rice portfolio company BrandSafway

Main Mezzanine backs MBO of Fairbanks

Company management took the majority stake and Rabobank provided senior debt for the buyout

Gilde backs MBO of Albelli

GP will draw capital from its €1.1bn fund V, which held a final close in November 2015

Triton buys Unica

Management and the van Vliet family will hold 49% of the new company, while Triton will take 51%

Mangrove holds first close on $170m for fifth VC fund

VC will target European technology companies in the early stages of development, with add-on capital available

Ergon Capital acquires Keesing from Telegraaf for €150m

Ergon is investing through the €350m buyout vehicle Ergon Capital III, closed in 2010

Main Mezzanine backs DMP

Main provided a mezzanine loan and took a minority stake alongside management

Carlyle acquires ADB Safegate from PAI Partners

Carlyle is investing from its €3.75bn mid-market vehicle Carlyle Europe Partners IV, closed in 2015

VEP buys Scheuten Glass

Acquisition solves a succession issue with the company's 69 year-old founder, according to the GP

Mentha Capital buys drilling equipment maker Brownline

Deal follows the recent €143m final close of the GP's fifth vehicle in January 2017

Main Capital raises €100m towards fifth fund

Vehicle has a target size of €200m and a €225m hard-cap, which the GP expects to hit before the end of the year

BlackFin in Buckaroo carve-out

Buckaroo is being sold by Intrum Justitia, which is 45% owned by Nordic Capital

Gimv buys stake in Snack Connection

Food production investor Trophas first acquired an interest in Snack Connection in February 2016

Gimv invests €15m in Arseus Medical

GP will draw capital for the transaction from its €150m Health & Care Fund, closed in March 2014

Five Arrows buys Voogd & Voogd from Bencis

Bencis led the management buyout of the Dutch insurance services business in 2013

Gimv sells stake in RES to Ivanti

Deal ends a seven-year holding period for Gimv, which initially invested in the company in April 2010

AAC sells industrial water purifying firm Desotec to EQT

Media reports suggest the water and air decontamination business was valued at around 10x EBITDA

BioGeneration Ventures holds €66m close for Fund III

Having exceeded its original €50m target, the vehicle is aiming for a final close on €75m by year-end

Brexit one year on: Flight to Luxembourg?

Many firms are keeping their options open with regards to future headquarters and fund domiciling, though some are looking to Luxembourg