CEE Unquote

RDIF et al. in Carprice, Travelata, Elementaree

RDIF is injecting capital jointly with its Russian, French and Middle Eastern partners

EI sells Danwood to trade for €140m

Enterprise Investors wholly acquired the company in a carve-out from Budimex in December 2013

Sequoia leads $45m series-B for Productboard

Round also saw participation from Bessemer Venture Partners and existing investors

MCI to sell Netrisk

During MCI Group's holding period, the company bolted on Biztosítás.hu in 2019

Resource Partners acquires Maced

Tomasz Macionga will continue as CEO, while Edmund Macionga will join the supervisory board

Elbrus leads $10m round for YClients

Elbrus is currently investing from its $550m vehicle, which held a final close in February 2014

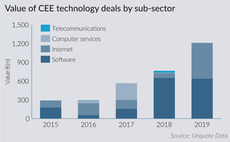

Software sector lures increasing amounts of capital in CEE

Interest in the software sector in CEE is on the up and was especially prominent in Q3

Poland's MCI gearing up for €400m maiden closed-ended fund

Vehicle will keep to MCI's strategy of backing buyouts of mid-cap technology businesses in the CEE region

Karma et al. back €1.5m round for MeetFrank

Company will use the capital to launch its new "relocation without location" feature

Jet Investment exits MSV Metal Studenka

Sale ends a six-year holding period for the GP, which bought the company via its Jet I fund

Lightspeed leads €128m round for Vinted

Funding round values Vinted at €1bn, making it Lithuania's first technology unicorn

V4C buys stake in Warsaw-listed Summa Linguae

Deal is contingent upon the prior closing of two acquisitions by Summa Linguae

Turbine secures €3m seed funding round

Alan Barge, a partner at Delin Ventures, joins the board of directors of Turbine

Mid Europa's Profi to acquire Pram Maya

Profi continues its expansion strategy by taking over Pram Maya's 18 stores in Prahova

BC Partners' United Group to buy Vivacom in €1.2bn deal

Netherlands-based telecoms and media provider United acquires its Bulgarian counterpart

TRG Management backs Amethyst Radiotherapy

TRG will help the Romania-based provider of cancer radiotherapy treatment to expand in Europe

Avallon to acquire Clovin

Avallon will take over a majority stake, with the founders retaining the rest of the shares

Tar Heel Capital raises €100m for THC 3 - report

Polish press reports that the firm has already made investments from the fund

Mid Europa sells Walmark to PE-backed Stada

Sale ends a seven-year holding period for the GP, which invested in the company via its third fund

CEE fund closes make headlines as dealflow slows

PE and VC activity has been rather sedate across the CEE region in October, with interim fund closes instead animating the market

Advent-backed Zentiva acquires Alvogen

Transaction is expected to close in the first quarter of 2020, subject to customary approvals

Livonia Partners to acquire Klaasimeister

Transaction will close subject to Estonian Competition Authority approval

Mezzanine Management et al. back Profi

Mezzanine Management makes the eighth investment from AMC IV

LauncHub Ventures raising new €70m fund

New fund has €25m committed to date and hopes to close in Q1 or Q2 next year