CEE Unquote

Arx buys TES Vsetin from Advent

Existing management team will lead the company's future growth and development

Genesis holds first close on €31m for GGEF I

Genesis Capital registered the fund in May 2018 and is targeting €40m for the vehicle

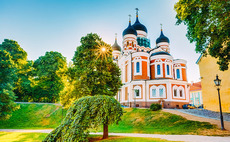

Livonia-backed Thermory buys Siparila

Latvian private equity firm Livonia backed the bolt-on via its first fund, Livonia Partners Fund I

Resilient Romania attracting PE

PE investment across all brackets has picked up in Romania this year, and CEE stalwart Mid Europa has just opened an office in the country

Tera Ventures et al. in $1.4m seed round for Snackable

Existing and new investors back the Estonian-American startup in its second investment round

H1 Review: Fundraising and local capital herald CEE buyout revival

Baltic market stands out, recording a higher than usual share of the wider region's dealflow

Mid Europa opens Bucharest office

New office will be led by Berke Biricik, a principal who joined Mid Europa in 2013

Innova closes sixth fund on €271m

Innova Capital has held a final close for its sixth fund on €271m.

Genesis buys 11 Entertainment Group

11 Entertainment Group is the eighth investment from Genesis Private Equity Fund III

Battery Ventures leads $33m round for Mews

Battery leads the series-B round, with principal Sanjiv Kalevar joining the board

Baltcap sells Auto24 to Apax-backed Baltic Classifieds

Auto24 marks the first bolt-on since Apax's investment and diversifies the group's portfolio

Actera Group sells Kamil Koç to VC-backed FlixBus

Sale ends a six-year holding period for Actera, which acquired Kamil Koç for approximately €25.5m

Mid Europa-backed Regina Maria buys Somesan Clinic

Addition of Somesan extends Regina Maria's reach to 19 counties and adds 20 outpatient clinics

Nation 1 launches debut fund with a target of €35m

Vehicle plans to invest in Czech startups and small and medium-sized companies with global ambition

Abris buys Global Technical Group

Tenth investment from Abris CEE Mid Market Fund III, a €500m buyout fund that closed in 2017

Innova buys Optiplaza

GP draws capital from Innova 6, a fund with a target of €325m that held a first close on €196m

V4C closes fund on €91m

Vehicle held a first close on €80m in January this year and has announced two deals

Up Invest buys Digiekraanid and Megameedia

GP will use the special purpose acquisition vehicle Media Investments & Holding for the transaction

CEE GPs use minority transactions to boost dealflow

Dealflow bolstered by the creativity of private equity firms, willing to team up or take minority stakes

Innova buys Optical Network

Innova will support the firm's plans to improve the product offering and customer experience

Triton-backed Dywidag buys Partec

Acquisition expands Dywidag's reach in eastern Europe and Scandinavia, where Partec is most active

Jet plans to double volume for third fund

Upcoming third fund will have a target of €350-400m, more than double the €153m raised for Jet Fund II

Jet Investment exits Benet Automotive to trade

Trade buyer Teijin has acquired the components manufacturer to push its expansion strategy in Europe

INVL buys Montuotojas

Deal was structured through two INVL Baltic Sea Growth Fund subsidiaries: BSGF Fortis and Montuja