Unquote

Saga closes fund-of-funds on EUR 720m hard-cap

Saga was founded by three former employees of Danske Bank's private equity department

KKR invests in Körber

Körber is a global supply chain software business founded in 1995

Hg invests in Bowmark-backed Pirum

Hg and Bowmark share joint control of Pirum with the company's management team retaining a significant stake

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Triton secures €1.45bn syndicated ESG-linked facility

Triton is the latest in a string of mainstream GPs to have announced ESG-linked loans this year

KCP hires new investment manager

Private equity house Key Capital Partners hires Sandeep Banga as investment manager in its London office

Q3 Barometer: PE scales new heights

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

Advent Tech II closes on USD 4bn

Predecessor fund in Advent's technology-focused strategy held a final close in 2019 on USD 2bn

Eir closes life sciences venture fund on EUR 122m

Nordic-based Eir Venture Partners has held a final close on EUR 122m for Eir Ventures I

PE firms study rivals' IPOs as they consider options

Recent slew of peer listings such as Bridgepoint and Petershill inspire key players as they mull options for their own businesses

Felix hires two new partners

Venture capital firm Felix Capital appoints Susan Lin and Julien Codorniou as its new partners

Inflexion reaps 6x on Halo trade sale

Inflexion accrues a 53% IRR from the sale of the network components manufacturer

Unquote Private Equity Podcast: To 12x and beyond

The Clearwater International Multiples Heatmap reveals that average entry multiples broke new records in Q3, on the back of a still-buoyant M&A market

LDC sells SRL Traffic Systems to 3i Infrastructure

LDC is to sell SRL Traffic System, a UK-based provider of portable and temporary traffic equipment, to 3i Infrastructure

Triton hires new CFO

Matthew Couch is set to join Triton as CFO in December

Average fund size reaches new heights amid stark market bifurcation

Average buyout fund close for 2021 stands at EUR 1.33bn, more than double the EUR 629m recorded in 2017

FSN sells EET to Pamplona in SBO

Pamplona Capital Management has agreed to acquire Nordic technology distributor EET Group from FSN Capital in a secondary buyout.

Intertrust draws interest from Apex Group

Rival approaches took place after Intertrust unveiled an exclusivity agreement with CVC on 12 November

Multiples Heatmap: TMT deals inked in Q3 pass 19x mark

Average entry multiples were again pushed into record territory in Q3 on the back of a still-buoyant M&A market

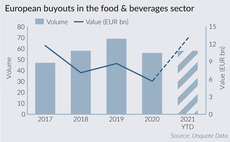

Food and beverage buyouts to reach EUR 13bn in 2021

An average of 44 buyouts totaling EUR 5.1bn were completed in the sector from 2011-2020

Bain gears up for sixth European buyout fund

US-headquartered GP held a final close for its previous European fund in 2018 on EUR 4.35bn

Spotlight on Spacs: Mobility sector ready to ride

With investors pressing for shorter merger deadlines, mobility-focused targets may fit the bill just fine

HSBC closes secondaries fund on more than USD 1bn

HSBC had previously raised USD 1.34bn for its first secondaries fund

PE funds rework packaging investments around ESG concerns

Can private equity's decades-long love affair with the packaging industry last?