Unquote

212.vc sets EUR 90m hard-cap for third fund

B2B tech-focused VC firm expects to reach a EUR 30m-40m first close for the fund by the end of Q1 2023

Adams Street raises USD 1.3bn for Co-Investment Fund V

Global strategy surpassed its USD 1bn target and will invest with buyout and growth equity GPs

GP Profile: Investcorp's GP stakes strategy sees strong dealflow ahead

Growing private assets market and changing LP perception will bolster GPтs mid-market strategy, Anthony Maniscalco tells Unquote

Emerging managers: "now is the time to back tomorrow's leaders" – Unigestion

Asset manager discussed outperformance of first-time funds and showcased new managers at a virtual event

GP Profile: Equistone banks on experience to ride through the next cycle

As the firm contemplates future fundraising, Unquote speaks to partner Tim Swales about the GPтs current outlook

Platform boot camp: Buy-and-build holds fast in healthcare sector

Healthcare M&A has held up well in 2022 versus 2021, offering hope in a challenging market

Permira Advisors shuts down Japan office

GP spokesperson says strategy is unchanged, will pursue opportunities in Japan selectively

Secondaries dealflow sees boost from primary fundraising, macro climate – Coller Capital

FranУЇois Aguerre and Michael Schad also discussed topics including credit secondaries

EU's pending foreign subsidies rules put PE deals in the spotlight

M&A from funds backed by Chinese and Middle Eastern investors likely to be the focus of enforcement

Sika draws sponsor interest in sale of MBCC assets

Chemicals company aims to address regulatory concerns over acquisition of German peer MBCC

PAI hires Odaro as head of ESG and sustainability

Denise Odaro joins from her role as head of IR and sustainable finance at the World Bank's IFC

Unquote Private Equity Podcast: Spotlight on GP-led secondaries

Travers Smith's Ed Ford and Sacha Gofton-Salmond share insights on structuring continuation fund deals and navigating an increasingly competitive environment

Fidelity markets EUR 1bn-plus debut direct lending fund

Asset manager is in discussions with prospective LPs for vehicle registered in December

The Bolt-Ons Digest – 17 October 2022

Unquoteтs selection of the latest add-ons with Equistone's Ligentia, Bridgepoint's Infinigate, Ambientaтs Namirial and more

Advent to merge Caldic with Wilbur-Ellis' Connell

Focused on nutrition, pharma, and industrial formulations, group aims to expand in APAC, LatAm

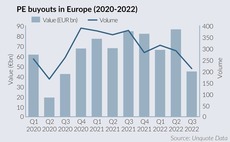

Private equity buyouts hit lowest point since COVID

Amid macro uncertainty, sponsors see EUR 44.6bn deployed across 211 buyouts, in the lowest mark since Q3 2020

BVCA Summit: PEs take long-term view to ride out uncertainty

Unquote reports on discussions around ESG, continuation funds and PE democratisation at last week’s event

Clearwater Multiples Heatmap: PE deals at record value in Q2 as macro pressure mounts

Sponsor transactions in Europe surged to an all-time high with TMT and the UK leading the way

EQT bolsters sustainability team with hire from Nordea

Ylva Hannestad joins GP’s client engagement around sustainability agenda

Secondaries Preview: Strong LP stakes dealflow, strategy specialisation to come in 2023

With some managers overexposed to single-asset GP-led deals, secondaries GPs are taking stock of opportunities for next year

Onex Partners aims for USD 8bn target with sixth flagship fund

New generation fund to remain similar in size to the USD 7bn fifth fund, with operational improvement a key focus

Private equity players warn of fundraising "shake-out"

Attendees at IPEM 2022 are bracing for challenging fundraising market to continue into 2023

Adams Street launches private credit platform in Europe

Investor hires James Charalambides from Sixth Street to lead new strategy out of London

Triago expands primary directs strategy to Europe

Adviser plans to build on existing US practice, supporting sponsors raising primary capital deal-by-deal