Tech overtakes consumer in Italy

Following the coronavirus outbreak, Italy has seen a significant increase in deal value and investment opportunities across the technology industry.

The pandemic has hugely accelerated the surge of the digital economy, spreading the need for every company to adopt innovative technology and achieve digitalisation of their customer services, supply chains, distribution networks, and internal operations.

With a growing number of tech-savvy consumers across the country, the spread of remote working and the need for additional security against cyber threats for businesses, a large pool of opportunities has arisen across the country, which is home to several technology-focused hubs.

Numerous Italian GPs with a generalist approach have reshaped their activity towards the tech sector and are increasingly making technology their first priority to attract international investors.

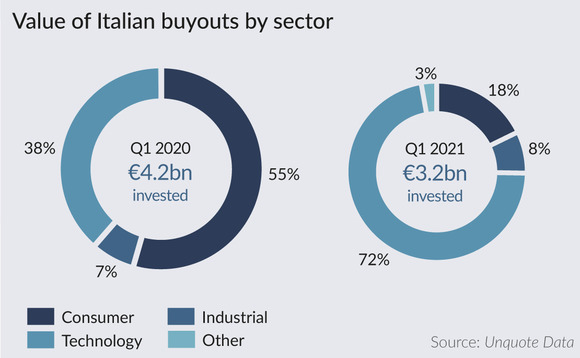

In Q1, the Italian tech industry recorded buyout investments worth €2.3bn, while the traditionally stronger consumer goods and services industry recorded deals for an aggregate value of €720m.

The largest buyout seen by the country in the technology sector was the acquisition of Lutech, which was bought by Apax Partners from One Equity Partners, in a deal valuing the company at around €500m. Lutech produces software dedicated to IT system integration, serving around 3,000 customers in eight countries. The business generates EBITDA of around €57m from annual turnover of €440m.

Other noticeable deals in the sector included the acquisition of a 70% stake in caravan navigation systems manufacturer SR-Mecatronic, bought by Itago via its fourth fund; and Heritage's purchase of Metoda, an ICT specialist with a focus on technology infrastructure, digital transformation and system integration.

Looking at deal volume, however, the consumer sector remains the busiest in the country, despite an increase in the tech segment compared to previous quarters, a trend that will further strengthen in the coming months, according to market experts.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds