Belgium

Pan-European GPs putting feet on the ground in Benelux

Pan-European GPs seek to tap Benelux's burgeoning buyout dealflow by securing talent familiar with the region

Ming et al. in €25m series-D round for Miracor Medical

Belgian public investors SFPI, SRIW and Meusinvest grant a non-dilutive cash advance

Riverside invests in Alter Pharma

GP is currently investing from its fifth fund, which targets businesses with EBITDA of €5-15m

Benelux funds specialise to compete with strategic buyers

Record level of commitments were secured by Benelux funds during 2017, with GPs increasingly turning to sector specialisation

HPE leads $19m series-C for NG Data

Other backers include Idinvest, Pamica, SmartFin, Capricorn and Nausicaa Ventures

Fortino holds €125m first close for second fund

New vehicle will expand the investment remit of the GP into more traditional market verticals

Emeram buys Meona and E.care

Newly created company will be jointly led by the management teams of Meona and E.care

CD&R to buy 40% stake in Belron group

Clayton Dubilier & Rice plans to acquire 40% of vehicle glass repair provider Belron

Alpha Private Equity buys Ipcom from Waterland

Acquirer uses Alpha Private Equity Fund 7, which closed on €903m earlier this year, to fund the acquisition

Gimv sells Luciad to Hexagon

Sale ends a four-year holding period for Gimv, which acquired the company in June 2013

Benelux open for business as trade sales recover

Nine months into 2017, the number of exits to trade buyers exceeds 2016's levels, reflecting healthy European corporate M&A activity

Gimv acquires 23.6% stake in Cegeka

GP plans to support the company's growth, both organically and by means of acquisitions

Riverside Europe collects €312m for fifth fund

Vehicle is still raising and currently €110m short of its €450m target, including GP commitments

Serena Capital leads €4m round for Elium

Government-backed Société Régionale d'Investissement de Wallonie (SRIW) also invested

Indufin sells Preflex Group to Wienerberger

Sale ends a 12-year holding period after a management buy-in worth around €10m in 2005

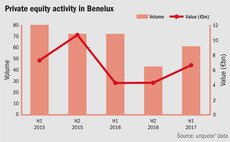

Benelux activity picks up in first half of 2017

Following a slow H2 in 2016, dealflow in the Benelux region is on the up with Belgium in particular seeing increasing activity

Halder-backed Aqua Vital buys Kalimba

Acquisition solves a succession problem for the company's founders, who started the business in 1996

Mentha mulling Optimum sale

Mentha Capital took a majority stake in Optimum in 2014, investing from Mentha Capital Fund IV

Ergon Capital acquires Keesing from Telegraaf for €150m

Ergon is investing through the €350m buyout vehicle Ergon Capital III, closed in 2010

Carlyle acquires ADB Safegate from PAI Partners

Carlyle is investing from its €3.75bn mid-market vehicle Carlyle Europe Partners IV, closed in 2015

Gimv invests €15m in Arseus Medical

GP will draw capital for the transaction from its €150m Health & Care Fund, closed in March 2014

AAC sells industrial water purifying firm Desotec to EQT

Media reports suggest the water and air decontamination business was valued at around 10x EBITDA

AAC Capital Partners acquires Verasol

Committed Capital acquired the veranda and garden room maker in 2009, investing through its first fund

Charterhouse takes majority stake in Serb

Deal will be the first ever buyout for the Belgian speciality pharmaceuticals group