Benelux

Mentha Capital acquires Aethon

Mentha recently completed its latest fundraising, having closed Mentha Capital V on €143m

Sofinnova's Avantium launches IPO with €277m market cap

IPO brought the renewable energy specialist a capital increase of €103m

Main Capital's Denit acquires Dutch Cloud

Transaction marks first bolt-on for Denit since Main's investment in the group in 2016

Waterland sells Mauritsklinieken to Holland Venture

Waterland Private Equity acquired a majority stake in the dermatological clinics group in 2010

Gimv in €7.8m series-B round for AgroSavfe

GP previously led a €5m round for the Belgian agro-biotech group in 2013

Riverside holds close on €175m for Riverside Europe V

Europe-focused generalist vehicle has been on the road for just over a year, having launched in late 2015

Waterland-backed Otravo acquires VakantieDiscounter

Deal marks the second large acquisition closed within the last 12 months with Waterland's backing

Karmijn Kapitaal sells Tuvalu Media

Karmijn acquired a controlling stake in the group in 2013 alongside company management

Fortino, Inkef, Partech in $23m series-B for Bloomon

Inkef and Partech had previously invested in the group through a series-A round in 2015

Waterland invests in Enhesa

Waterland recently closed its sixth buyout fund, WPEF VI, on €1.55bn

Core Equity launches €1bn long-term fund

Firm was founded by former Bain Capital senior team members Sarkis, de Waen, Stoessel and Valentiny

Parcom Capital takes majority stake in MGG Group

LIOF, private equity arm of Dutch province of Limburg, was previously majority owner in the group

Paragon Partners buys Novagraaf from Gilde

Gilde Buy Out Partners became majority owner in the group in 2007, taking over from Halder and NIP Capital

Gimv leads €10.3m round for Itineris

Fourth funding round brings total raised by Flemish group to over €30m

Gilde Buy Out Partners sells HG International to Cobepa

GP had taken over the group from sister firm Gilde Equity Management in 2013

Mentha Capital closes Fund V on €143m

Mentha Capital Fund IV (MCF IV) closed on €107m in 2015, ahead of its €100m target

Indufin invests in software developer AXI

Indufin is taking over from ING as the main investor in the software group

HenQ leads €5m series-A round for Housing Anywhere

New funding round brings the total amount raised by the Dutch startup to $6.27m

Main Capital invests in Artegic

Benelux player Main Capital opened a local office in the DACH region in August

MyTomorrows raises €10m from EQT, Octopus et al.

Latest funding round brings the total raised by the startup to $22.14m

3i's Action in €1.675bn refinancing

GP will receive approximately £187m in proceeds from the transaction

Blackstone acquires Acetow from Solvay for €1bn

Sale, representing a 7x EBITDA multiple, should help Solvay reduce debt with €150m capital gain

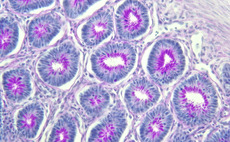

Meusinvest, Spinventure in €4m round for PDC Line Pharma

Round included €2.6m equity and €1.4m in bank loans, EU funding and French and Belgian regional funding

Karmijn Kapitaal leads €10m round for Five Degrees

Karmijn invested via its €90m vehicle Karmijn Kapitaal Fund II