coronavirus

ICG launches second recovery fund

Second vehicle will be larger than its predecessor, which closed on тЌ843m in March 2010

How the crisis could affect fund T&Cs

In a tough funrdriasing and deal market, GPs will be looking for all the incentives they can possibly provide

Marcol invests in Fernarzt, launches new HealthHero platform

Seed investor Heartbeat Labs will retain a 10% stake in Fernarzt

Finland's VC industry remains buoyant despite pandemic

Dealflow in the Finnish VC market remained strong in the peak months of the coronavirus outbreak, with local players cautiously optimistic

EQT closes acquisition of Schülke

Deal values the hygiene products producer at €925-1bn, subject to an earn-out provision

Programma 102 closes on €100m

VC will launch a new vehicle by the end of the year, with a тЌ100m target, to focus on complementary asset classes

Fashion victims: GPs face a tough year in the clothing & accessories sector

Unquote explores dealflow expectations and potential silver linings for the segment, which has been one of the hardest hit by the pandemic

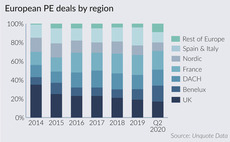

PE exits hit decade low in Q2

Volume of exits by PE players across Europe fell by 43% year-on-year in Q2 2020 as the coronavirus crisis took hold, according to Unquote Data

GP Profile: Emeram Capital Partners

DACH-focused GP anticipates the launch of its second fund following a portfolio assessment and digital AGM

QIA et al. invest $162m in CureVac

mRNA vaccine developer is valued at $1.6bn and also secured backing from the KfW and GlaxoSmithKline

Apax VIII and Apax IX post higher valuations than Q4 2019

Both funds have valuations of more than 14% higher compared with valuations in March 2020

BGF-backed Xercise4Less prepares for administration

Gym chain recorded losses of ТЃ10.4m on ТЃ40m revenues in the most recently available accounting year

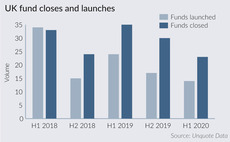

UK fundraising update: pausing for breath

A number of GPs that closed more than three years ago have delayed fresh fundraises, or have altogether decided to explore new options

Market sentiment improving but dealflow likely to remain bifurcated – Baird

Baird MDs Vinay Ghai and Paul Bail discuss deal-making amid the pandemic and emerging trends for the months ahead

Mercia invested £17.5m in 2019/20

Mercia's NVM VCTs raised ТЃ38.2m in new capital, while the BBB also allocated an additional ТЃ54.3m

LDC's makes 18 investments in H1 2020

In a half-year update, the firm announced the majority of the deals were completed since March

Moira invests in logistics operator Goi

Moira intends to support the company's growth and expansion both in Spain and internationally

Nauta Tech Invest V holds €120m first close

Fund deploys tickets of тЌ1-5m in seed and series-A rounds to support European B2B SaaS startups

Wise Equity buys Fimo from IGI

This is the first deal inked by the GP via Wisequity V, which closed on its €260m hard-cap in July 2019

B Capital closes second fund on $820m

Fund invests in series-B, -C and -D rounds to support B2B and B2C startups based across Asia, Europe and the US

Antares launches €300m UTP fund for fashion sector

Fondo Lusso & Lifestyle is dedicated to bank credits, with a special focus on UTP exposures

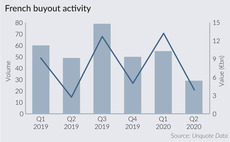

Lockdown impact derails French buyout momentum

Even as France is now moving on, the uncertain road ahead is threatening to undo months of improving activity and market sentiment

Aldea Ventures launches €150m fund-of-funds

VC house expects to hold a €35-45m first close by the end of July and a final close in around one year

Alcedo to launch €230m fifth fund

Alcedo V will target Italian companies with high-growth potential and an export-orientated approach