coronavirus

Capdesia Structured Equity targets £100m; aims to close in Q1 2021

European food-service-focused fund was registered and launched in May 2018 with a target of тЌ200m

White Star holds first close for $30m Digital Asset Fund

Fund invests in blockchain-enabled businesses at each layer of the tech stack, with a focus on Europe and the US

Arcano Secondary Fund XIV launches with €300m target

Fund will invest in mid-market buyout and growth capital vehicles across Europe and the US

Clarks in refinancing provided by LionRock - report

A deal would see Clarks raise an investment in exchange for a dilution of the Clark family's holding

Unquote Private Equity Podcast: Allocate 2020 special

The Pod discusses our upcoming LP/GP conference, Allocate, touching on illiquidity solutions, secondaries, and ESG

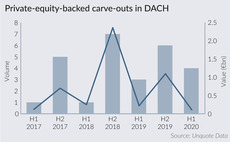

PE players await DACH carve-outs uptick

With corporates under pressure due to the coronavirus pandemic, opportunities are likely to open up for sponsors interested in carve-outs

Anima Alternative launches €200m direct lending fund

Fund will deploy financing to support the recovery and expansion of Italian SMEs operating in a wide range of sectors

Talde launches €150m fund

Fund targets Spanish companies operating in a wide range of sectors, with revenues in excess of €20m

Astorg's Aries Group to offload two subsidiaries – reports

Beleaguered aerospace sub-contractor is looking to sell ACB and Dufieux, according to local reports

Dawn closes fourth fund on $400m hard-cap

Dawn Capital III closed on ТЃ165m in April 2018 and has now made its final initial investment

FIEE holds €127.5m first close for second fund

Fund targets the energy efficiency, renewables, lighting, co-generation, pollution control and smart city sectors

Nexxus Iberia buys STM

GP invests in the company via Nexxus Iberia Private Equity Fund I, which closed on €170m in February 2020

Unquote Private Equity Podcast: H2 Preview

The Unquote Podcast gathers the whole team this week to go over H1 statistics, look at early recovery signs and share insights from across Europe

Panakes to launch €120m second fund within months

VC expects to start raising capital by the end of the year and hold a first close in H1 2021

Private Equity Pitch: Funds exposed to UK consumer services providers

Unquote and Mergermarket look at individual funds' exposure to UK businesses in the consumer services space

DACH holds up under pandemic pressure, but recovery doubts remain

Market players suggest it is unlikely that H1 figures reflect the extent of the damage done to portfolios and M&A

Q2 Barometer: Coronavirus ravages European M&A market

After the first effects of the Covid-19 crisis were felt in March, the European private equity market decelerated sharply in Q2

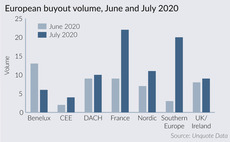

Southern Europe bounces back amid pandemic uncertainty

Southern European market has regained vigour and confidence in July following a catastrophic H1

EQ Asset Management eager to deploy following double fund close

EQ says it has completed five acquisitions through its secondaries fund since the outbreak of Covid-19

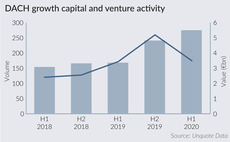

DACH venture and growth deals reach volume high in H1 2020

Growth and VC deal volume exceeded that of all previous half-yearly figures, although average deal size and fundraising activity declined

GP Profile: FPE Capital

FPE Capital is now gearing up to begin making investments again in the technology sector, says managing partner David Barbour

Debt funds making inroads in DACH amid Covid-19, says GCA

GCA's Mid Cap Monitor shows that debt funds financed 71% of German LBOs in H1 2020, with the firm expecting an activity uptick in Q4

Venture, tech keep UK market afloat in H1

Buyout and exit volume dropped dramatically in the first half of 2020, while GPs are doubling down on technology-driven strategies

France, southern Europe drive dealflow uptick in July

Buyout market is picking up again following one of the worst slumps on record, with some of the regions originally hardest hit becoming busier