Denmark

EQT to sell Fertin Pharma to Philip Morris

EQT exits the company four years after it acquired a 70% stake in it from the founding Bagger-SУИrensen family

KKR opens office in Stockholm to step up Nordic activity

The office is the GP's ninth in EMEA, in addition to Paris, Frankfurt, Madrid, Dublin, Luxembourg, London, Dubai and Riyadh

Riverside buys Danish cybersecurity firm Cryptomathic

GP was supported by its institutional co-investors on the deal and plans to carry out add-ons in the cryptography space

Altor acquires Multi Wing Group

Company was reportedly marketed based on EBITDA of тЌ16m

Axcel acquires veterinary care provider VetGruppen

Company's co-founder and chief operating officer Rasmus Hansen will remain a significant co-owner alongside the GP

Blue Cloud Ventures leads €50m round for Templafy

Insight Partners, Dawn Capital, Seed Capital and Damgaard Company also take part in the round

Triton to acquire FairWind

Triton has signed an agreement to acquire a majority stake in Fairwind, a Danish provider of wind turbine installation and related services.

EQT Ventures backs Lenus with €50m series-A funding

Round is the largest series-A round ever secured by a startup in Denmark, according to EQT Ventures

Nordic H1 VC and growth deal value at all-time high

Nordic venture capital and growth investment has recorded its highest aggregate deal value in the first six months of a year

Great Hill invests $55m in software company Eloomi

GP reportedly acquired a third of the company in a deal that valued Eloomi at more than DKK 1bn

Polaris launches flexible capital strategy with DKK 1bn fund

GP starts raising a DKK 1bn fund for the new strategy and plans to hold a first close after summer this year

Blue Equity holds first close on €78m for third fund

Latest fund will focus on acquiring majority and minority stakes in Danish B2B companies with revenues of DKK 50-250m

Gro-backed Trifork to list in €400m IPO

Planned exit comes six years after software investor Gro Capital invested €6m in Trifork for a 20% stake

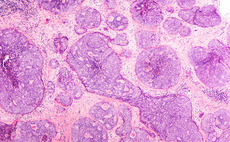

Gilde Healthcare buys majority stake in Klifo

Gilde Healthcare has now made five investments from its Gilde Healthcare Services III fund

Corpfin sells Secna to EQT's Chr Hansen

Sale ends a six-year holding period for Corpfin, which bought a 51% stake in the company via its €255m fund IV

Novo Seeds, Ysios Capital lead €51m round for Adcendo

RA Capital Management, HealthCap and Gilde Healthcare also take part in the round for the biotech startup

Triton acquires Geia Food from Credo Partners

Credo exits the company after acquiring a 55% stake in Geia in 2017

Gro Capital invests in Danish firm Luxion

According to Borsen, the GP's stake is more than 35% and that the deal valued Luxion at almost DKK 1bn (тЌ134.5m)

Polaris merges four financial advisory firms into North

Deal is the third from Polaris Private Equity V, which launched in 2019 and was targeting тЌ550m

Capidea acquires Obsidian Group

Deal follows an auction process initiated by the company at the end of summer 2020 and was led by Deloitte.

Hg acquires Trackunit from Goldman Sachs, Gro Capital

Sale comes nearly six years after the GPs acquired the company

Nordic Capital acquires minority stake in Leo Pharma

GP's stake is reportedly smaller than 25%, with the current owner remaining as the majority shareholder

Triton reaps 2.4x return on sale of Logstor

Deal comes more than seven years after Triton invested in Logstor via Triton Fund III

Brygge Partners invests in Tier 1 Asset

Founder and CEO Peter Hemicke will reportedly own 57.5% while board chaiman Lars Aean purchased 5%