Nordic H1 VC and growth deal value at all-time high

Following on from a strong performance in 2020, despite the pandemic, Nordic venture capital and growth investment has recorded its highest aggregate deal value in the first six months of a year. Eliza Punshi reports

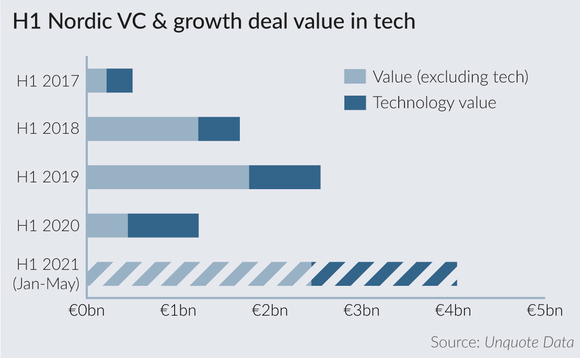

The amount of early-stage private equity investment in the Nordic region in 2021 reached an all-time high for an H1 period, with June's figures yet to come. Until the end of May this year, Unquote Data recorded early-stage venture and growth deals in the Nordic region with a total aggregate value of €4.04bn, up 231% from €1.22bn in 2020, and 62% from €2.5bn in 2019.

Sweden and Denmark have seen the strongest activity in 2021, with €1.4bn in aggregate deal value in Sweden and €1.3bn in Denmark. Finland has also seen a record year, attracting €869m in venture and growth investment, higher than any previous H1 for the country.

Notable VC rounds include for Swedish electric car maker Polestar, which raised €469m in a series-B round; Finnish food and grocery delivery service provider Wolt, which raised €432m; Swedish digital healthcare company Kry, which raised €262m in series-D funding; Danish biotech firm IO Biotech, which raised €127m in a series-B round; and Oslo-based online grocery retailer Oda, formerly known as Kolonial, which raised NOK 2.2bn (€220m).

Technology companies made up the bulk of the deals in H1 2021, with exactly half of the 88 deals involving software companies, followed by consumer, with 12 deals, and healthcare, with 11 deals.

Many of the companies that raised money this year are those that have proven their resilience in the face of the pandemic, or have seen demand for their goods or services accelerate as a result of the pandemic, such as e-commerce, logistics companies, and software businesses.

Consequently, companies that have weathered the pandemic are seeking very high valuations. Kry, whose €262m round was led by CPP Investments (CPPIB) and Fidelity Management & Research, is valued at $2bn. The company said in a statement that it grew by 100% year-on-year in 2020 in response to supporting patients and healthcare systems across Europe during the coronavirus crisis. Last month, TCV led a $150m series-B funding round for Norwegian software company Cognite. The deal gave the company a valuation of $1.6bn, up significantly from $550m in November 2020 when it raised $75m from Accel Equity.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds