Exclusive

Pantheon raises USD 624m for GP-led secondaries programme

Unquote recaps the fundraise and investment strategy with managing partner Paul Ward

Turkven expects Turkey Growth Fund IV final close in mid-2022

Previous fund held a final close in 2012 with capital commitments of USD 840m

Committed Advisors closes CAPF I on EUR 161m

Primaries, early secondaries and co-investment fund is intended to extend the GP's existing strategy

EQT launches EQT Future fund

Fund has a EUR 4bn target and intends to make impact-driven investments in mature companies

Sofinnova holds EUR 472m final close for Capital X

France-headquartered VC will continue to focus on early-stage healthcare investments

GP Profile: Phoenix returns record amounts in last 12 months

Unquote catches up with managing partner David Burns to discuss recent activity and where the firm is headed next

2021 European PE exits already exceeding full 2020 tally

GPs are clearly looking to seize the initiative and clear out portfolios amid a general push to ink deals on the buy-side

Unquote Private Equity Podcast: Jersey doubles down on ESG

Unquote speaks with Elliot Refson to discuss how the jurisdiction is looking to better understand LP expectations and foster an ESG-focused ecosystem

Ufenau on track for Q1 2022 fundraise

Switzerland-headquartered service-focused GP is planning to raise its seventh flagship fund

Ambienta eyes larger size for fourth fund

Depending on the deployment of the current vehicle, Ambienta could start fundraising in 2022-2023

Ace Capital raises EUR 175m for cybersecurity fund

Brienne III held a first close on EUR 80m in June 2019 and ultimately exceeded its target

Summa sells Lakers for 5x money

GP acquired the waste and wastewater pump service provider in 2018 via its debut fund

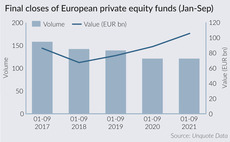

European GPs raise record amounts in first nine months of 2021

Raising EUR 105.5bn in aggregate commitments is a 30% increase on the average amount raised in comparable periods over the previous four years

Finberg to raise USD 25m for new IFR fund

Turkish corporate VC firm backed by Fibabanka and Fiba Group moves toward third-party funding

European buyout dealflow up 36% year-on-year in Q3

Europe was home to 346 buyouts worth an aggregate EUR 69.8bn in the third quarter, preliminary figures indicate

Main Capital raises EUR 1.2bn across two funds

Of the capital raised, Main Foundation I has raised EUR 210m to back smaller software companies

PAI lines up next flagship fund

PAI Partners VIII is registered in Luxembourg, with its predecessor having raised EUR 5bn in 2018

European PE activity could reach EUR 400bn mark in 2021

Aggregate value for 2021 to date is already higher than that seen in any full-year on record, with a full quarter still to play out

Five Seasons closes second fund on EUR 180m

Food-technology-focused VC held a final close for its debut fund on EUR 77m in 2019

Fund financing and ESG: from the impact niche to the mainstream

ESG-linked fund financing facilities are becoming a prominent т and well publicised т tool in the ESG toolbox for GPs and lenders

Kyma Partners holds EUR 100m first close for debut fund

Italy-headquartered GP focuses on the digitalisation of Italian SMEs and is targeting EUR 130m

GP Bullhound closes Fund V on EUR 300m

Technology-focused firm's predecessor vehicle held a final close in June 2019 on EUR 113m

Mirova launches debut impact fund with EUR 300m target

Fund will invest on a pan-European basis

European IPOs reach seven-year high in first nine months of 2021

Sponsors have been on the ball when it comes to capitalising on the IPO window this year, according to Dealogic data