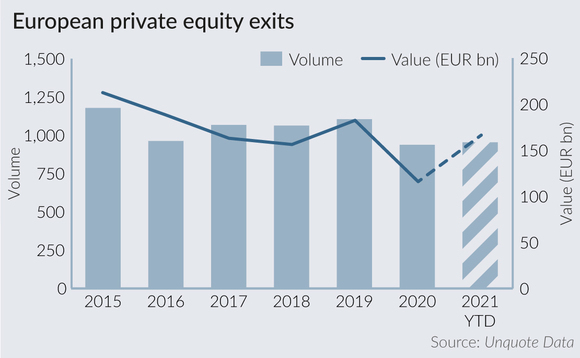

2021 European PE exits already exceeding full 2020 tally

Private equity players have matched a buoyant inbound investment activity with a sharp increase in disposals this year, according to Unquote Data.

Unquote has recorded 954 exits so far this year, worth an estimated aggregate of EUR 166.4bn. This means that, with nearly a full quarter of usually frantic activity still to come, the 2021 tally to date already exceeds the numbers seen for the whole of 2020. Last year, with Q2 being particularly barren given the coronavirus outbreak, Unquote recorded 937 divestments amounting to an overall EUR 115.9bn.

Assuming that dealflow continues at pace in the remaining weeks of 2021 and Q4 ends up seeing north of 300 exits, the full-year total for this year should be among the most impressive seen over the past decade.

GPs are clearly looking to seize the initiative and clear out portfolios amid a general push to ink deals on the buy-side. While corporates have been hungry for M&A, PE itself has been deploying record amounts in 2021. As reported, Europe was home to a record number of deals in the first nine months of the year, with Unquote estimating that the aggregate value of investments could approach EUR 400bn by year-end.

With PE houses keen to both buy and sell, secondary buyouts have unsurprisingly been plentiful. Around a third (32%) of all exits inked in 2021 so far have been to a fellow GP, while that proportion stood at around a quarter (26%) in 2018-2019.

But sponsors have also capitalised on the IPO window this year, with European IPOs reaching a seven-year high in the first nine months of 2021, as reported. Among the 2021 blockbusters were the USD 3.9bn IPO of Poland's InPost by Advent International, Hellman & Friedman's USD 2.6bn listing of Spanish fund platform Allfunds, and the much-scrutinised Bridgepoint-backed Deliveroo IPO worth USD 2bn.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds