Germany

Finatem buys Mungo Befestigungstechnik

Selling consortium includes the CEO, Oliver Annaheim, who will retain a minority stake

VR Equitypartner, SüdBG sell Piller to Riflebird

Fresh capital from the transaction will be used to drive Piller's expansion into the US and Asia

Capnamic, ProFounders lead €4m series-A for NDgit

Existing investor Dieter von Holtzbrinck Ventures also takes part in the financing round

BC-backed Springer Nature sets price range for €3.6bn IPO

Company is targeting proceeds of up to €1.6bn from the primary and secondary offering

Verdane buys portfolio from Bauer Media Group

Portfolio comprises three German companies including women's fashion brand Navabi

VC-backed NFon sets price range for €200-239m IPO

Company aims for a post-money market cap of €200-239m and a free float of up to 68.9%

Golding hires BlueBay's Das as head of private debt

Das will be responsible for selecting primary, secondary and co-investment opportunities

VC firms lead $29m series-B for Clark

Coparion, Kulczyk Investments and Yabeo Capital also take part in the latest financing

EQT partially divests EIS Aircraft Group

EQT remains invested in the EIS Aircraft Products and Services division

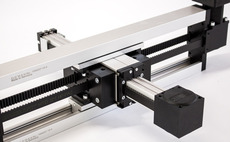

IK buys Bahr Modultechnik

GP draws equity from IK Small Cap II, a €550m fund that held a final close in February 2018

Paragon-backed Chicco di Caffè buys Bota Group

Selling shareholders Pius Widmer and Bruno Wanske exit to pursue other opportunities

New Enterprise et al. back $20m series-B for Konux

Round is led by US-based New Enterprise Associates with participation from MIG funds

Rocket Internet sells €150m HelloFresh stake

Placement is made via an accelerated bookbuild offering to institutional investors

Gilde Healthcare's Rad-X buys TelradKo

Acquisition will provide TelradKo with fresh capital to accelerate its expansion

VC-backed NFon aims to raise €50m in Q2 IPO

Company targets gross proceeds of €50m, which will be used for further European expansion

GP Profile: Deutsche Private Equity

GP has deployed 44% of its third fund within 15 months of the vehicle holding its final close on €575m

Project A, Vito lead €4m seed round for Artisense

Chris Hitchen, an entrepreneur and venture adviser to EQT Ventures, also takes part in the round

UVC Partners holds final close on €82m

Vehicle was originally launched in September 2016 with a hard-cap of €60m, which was later revised

BC-backed Springer Nature announces intention to float

BC Partners may make a secondary placement of shares and will provide shares for a greenshoe option

Acton leads €7m series-A for Cluno

Existing investor Atlantic Labs also takes part after providing seed capital in 2016

Adiuva Capital-backed AC Dental buys NT Dental

Adiuva generally makes investments between €5-40m for majority and minority positions

Lindsay Goldberg sells VDM to trade for €596m

GP was represented in the sale by its European subsidiary Lindsay Goldberg Vogel

Capvis, Partners Group buy Amann Girrbach from TA

Capvis draws equity from its new DACH-focused buyout fund Capvis Equity V, targeting €1bn

Iris leads €20m round for Jedox

Early-stage investor eCapital and Swiss family office Wecken & Cie are also taking part