Italy

Ambienta buys AromataGroup

Current management team will continue to lead the firm and retain a minority holding

Italglobal Partners acquires Gimel

GP led a club of investors to acquire a 70% stake in the Italian children's clothing manufacturer

United Ventures' Moneyfarm buys Vaamo Finanz

Following the deal, Vaamo co-CEOs Thomas Bloch and Oliver Vins will join Moneyfarm's executive board

Neuberger Berman, NB Aurora exit General Medical Merate

NB's stake was acquired by the Sordi family and Kangda Medical Equipment Group

Invitalia Ventures, Primomiglio lead €3m round for Brandon

Sella Ventures, Sinergenis, Ecilog and private investor Fabio Cannavale also take part in the round

Wise-backed Tatuus bolts on Breda Racing

GP plans to boost the two companies' internationalisation and achieve strong operational synergies

One Equity-backed Lutech bolts on Tecla.it

Deal also includes the acquisition of two subsidiaries controlled by Tecla.it

F2i holds €3.6bn final close for third fund

Vehicle was launched with a €3.3bn target and held a €3.14bn first close in December 2017

Ambienta exits Aico

Sale ends an eight-year holding period for Ambienta, which bought the company via its first fund

NB Renaissance Partners' Comelz bolts on Camoga

Following the acquisition, Comelz expects to reach EBITDA of €30m from revenues of €75m in 2018

BC Partners' Cigierre bolts on Pony Zero

Company will use the fresh capital to expand its service offering and enlarge its customer base

Luxury fashion à la mode for private equity buyers

Sky-high valuation of Versace at тЌ1.83bn equates to 41x the company's 2017 EBITDA of тЌ44.6m

IGI's Fimo bolts on DCE

Marks the second add-on inked by Fimo, following the acquisition of Polyform in December 2017

EOS Investment buys Neronobile

Equita Private Debt Fund supported EOS IM's acquisition by fully subscribing to a subordinated bond

Star Capital exits Gia

Sale ends a six-year holding period for the GP, which bought the company via its Star Bridge Fund

Principia backs Gada

Company's management will retain the remaining minority holding and continue to lead the business

Star Capital exits CastFutura

Sale ends a five-year holding period for Star Capital, which acquired the company from Synergo

PEP's IDB bolts on Saba Italia

Saba Italia is the fifth bolt-on inked by IDB, which expects to reach a turnover of €100m in 2018

BC Partners-backed Cigierre bolts on Temakinho

Temakinho founders will retain a minority stake in the business and continue to lead the company

Star Capital backs IPS and Moda Italia in MBO

GP is investing via its Star IV Private Equity Fund, launched this year with a €120m target

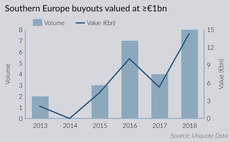

Southern Europe heats up with record levels of mega-deals

Volume and value of €1bn+ buyouts in the region reached their all-time peaks in the first nine months of 2018

KKR's Calsonic bolts on Magneti Marelli in €6.2bn deal

FCA will enter into a supply agreement with Magneti Marelli to support its operations in Italy

HIG-backed SLPA bolts on Eco-dex

Company will continue to operate under its brand and to be managed by its current CEO Loïc Bessin

Blackstone, Goldman invest €100m in Prima Assicurazioni

Co-founders Alberto Genovese and Teodoro D’Ambrosio will retain a majority stake in the company