Market Insight

Majority of LPs happy to commit without in-person meeting – survey

Cebile Capital survey finds that 51% of respondents expect to increase PE commitments in 2021

Quantifying PE's appetite for recurring revenue models

Buyouts in sectors where recurring revenue models are predominant went from 8% of European volume in 2010 to 22% in 2021 to date

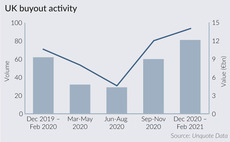

How UK PE buyouts soared ahead of 2021 Budget

Amount of dealflow in the past three months is significantly higher than in previous December-February periods

PE firms more bullish than corporates on distressed M&A – survey

Of the PE firms surveyed, t4% cite distressed/turnaround opportunities as a major motivation for acquisitions

DACH buyout market weathers Covid-19 impact, UK and France suffer

Germany emerged as the busiest region in Europe in Q2, albeit with a low volume and aggregate value of deals by historical standards

PE exits hit decade low in Q2

Volume of exits by PE players across Europe fell by 43% year-on-year in Q2 2020 as the coronavirus crisis took hold, according to Unquote Data

PE secondaries volume cut by more than half in H1 - survey

Private debt fund secondaries were hit even harder with an 81.8% plunge, Setter says

Italian PE: an opportunity in crisis

The latest edition of Gatti Pavesi Bianchi's series on the Italian private equity and M&A markets is now available to download

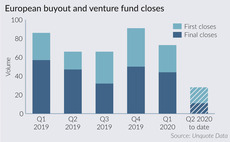

European fund closes slump by 42% amid lockdown

Unquote recorded 44 first or final closes of European PE funds between March and May, a 42% drop on the three-month average seen across 2019

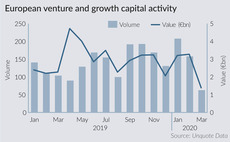

VC, growth activity collapses in March amid Covid-19 outbreak

European VC and growth capital dealflow was no more sheltered than its buyout counterpart

Annual Buyout Review: European momentum likely to be hit hard

Unquote's lastest Annual Buyout Review is now available to download, offering in-depth statistical analysis of European buyout activity in 2019

Italian PE: Strength in numbers

First three quarters shaped up well in terms of volume, with total deal numbers marginally higher than those for the same period in 2018

Q4 Barometer: European deal volume sets new annual record

Despite a slowdown in the final quarter of the year, private equity activity reached an all-time high over the course of the year

Q3 Barometer: European PE's strongest third quarter

European market had its most active third quarter on record in 2018 in terms of dealflow

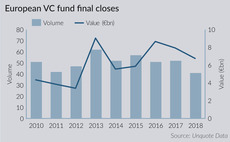

European VC fundraising continues strong showing

VC fundraising totals over 2016-2017 marked a healthy increase of nearly 50% on the amounts raised in the previous two-year period

Q2 Barometer: European private equity hot streak continues

Average European PE deal value hit a post-crisis peak in Q2, while quarterly volume reached the highest level on record

Italian PE back in fashion

Despite a drop-off in 2017, total Italian PE value last year is still almost double that of the €4.1bn invested in 2012

Q1 Barometer: Mega-deals propel value to post-crisis record

Deal volume reached the second highest quarterly level in two and a half years, while aggregate value climbed to тЌ54bn

Q4 Barometer: Deal volume and aggregate value slide

Despite a boom in both dealflow and aggregate value across 2017 as a whole, the final quarter of the year saw a slowdown in activity

Q3 Barometer: Market pauses for breath

European dealflow slows down compared with previous quarter but remains at historically elevated level

Average entry multiple climbs to 10.8x in Q2

Price inflation has led average European multiples to rise further in Q2, according to the latest unquote" and Clearwater Multiples Heatmap

Q2 Barometer: Aggregate PE deal value reaches 10-year peak

Deal numbers climbed for the second consecutive quarter, boosted by buyouts and growth capital deals

Average multiples remain stable at 10.2x in Q1

European valuations keep track with 2016, but drop slightly compared to Q4 2016

Q1 Barometer: Fall in buyouts sees aggregate value drop 30%

Early-stage and expansion deals up, while buyout volumes and values drop