Market Insight

European entry multiples rise to 10.2x in 2016

CEE, southern Europe and the Nordic region drive average price increase, while UK valuations drop

Q4 Barometer: Large-cap deals boost value in a shrinking market

Spike in megadeals boosted aggregate deal value in Q4, though volume was down 20% year-on-year

unquote" LP and secondaries round-up

European fund-of-funds managers look to raise new vehicles, LPs increase private equity allocations, and more in this unquote" round-up of LP news

Q3 Barometer: Core mid-market buyouts return to growth

Mid-market deal volume across Europe reached its highest total in five quarters

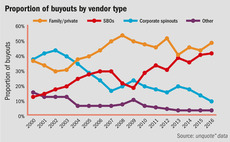

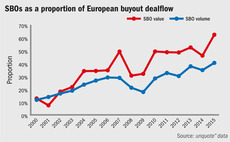

Secondary buyout levels reach new heights

SBO market in Europe has developed steadily over the last 15 years

European entry multiples rebound in Q2

Following a dip in Q1, multiples for European PE-backed buyouts have returned to 2015 levels

Polish buyouts keep CEE afloat

Poland has established itself as the largest buyout space in CEE

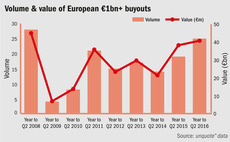

Southern Europe leads renaissance of billion-euro club

Dealflow in the тЌ1bn+ buyout segment reached an eight-year high across Europe in the 12 months to Q2 2016

Q2 Barometer: European buyout activity rebounds

European deal volume reached its highest total in six quarters, while aggregate value increased by 80% compared to Q1 levels

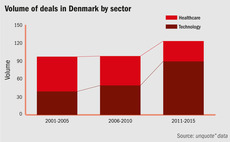

Denmark increases share of Nordic PE deals

Southernmost Scandinavian country was the busiest country by deal volume in 2015

Berlin keeps Germany afloat

The German capital has emerged as the lone bright spot in the country, buoying the German private equity industry

Tech drives Danish PE as healthcare loses ground

Denmark's technology sector has fueled the rise of the local private equity industry

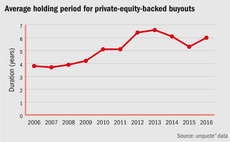

Holding periods lengthening again following 2015 drop

Holding periods for assets exited in so far 2016 have climbed following a drop in 2015, but still sit lower than the 2012-2014 average

Entry multiples still in double digits for most popular European markets

The latest unquote” and Clearwater International Multiples Heatmap Report, now available for download, neatly reflects the ever-challenging environment for private equity investors.

Tech startups power Italian recovery

Over the past few years, tech startups have accounted for an increasingly larger proportion of the Italian private equity landscape

Q1 Barometer: Slow start across Europe despite French uptick

The European buyout segment witnessed a slow Q1 volume-wise, with the number of deals recorded being the lowest total since Q1 2014

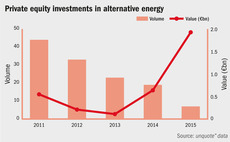

Private equity continues to shy away from renewables

Declining dealflow confirms the industry's move away from alternative energy, despite two large deals inked in 2015

UK buyout activity suffers deepest decline since 2009

The volume of buyouts witnessed so far for the first quarter of 2016 is the lowest on record since 2009

Secondary buyouts reach new heights

Europe sees new record for SBOs, with 40% of European buyouts sourced from other GPs in 2015

Multiples Heatmap Q3 update: prices heat up in France, CEE

Download the latest instalment of our ongoing project tracking average multiples paid by private equity

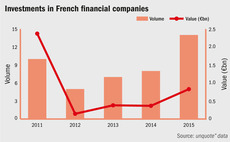

France's financial sector surges ahead

Private equity dealflow within the financial sector in France has reached a record high, according to unquote" data

Q4 Barometer: Record value in 2015 despite end-of-year dip

Fewer deals but higher aggregate value in 2015 meant the average deal value jumped by a whopping 53%

Value of European buyouts rose by almost 35% in 2015

Leading with an impressive hike in aggregate value, discover the key findings of our Annual Buyout Review

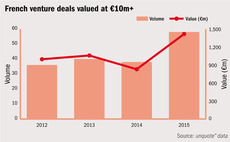

Competition, maturity drive swell in French VC investments

Paris's venture scene is thriving, with increasingly larger investments being deployed