Netherlands

Standard Investment sells Dutch Bakery to Egeria

Standard Investment created the bakery chain through a series of mergers in 2015

3i hires three in private equity team

Bruchmann joins as director, Supple as senior associate and van der Voorden as associate

H2 Equity Partners acquires Poultry Machinery Joosten

Firm buys a majority stake in the developer and manufacturer of poultry processing systems

Alteri acquires Intertoys from Blokker

Dutch toy retailer will invest in marketing activity, its online platform and store refurbishment

EQT buys Curaeos from Bencis

Bencis made the first acquisition in its dental buy-and-build strategy in July 2011

DH Private Equity's TMF seeks €340m London IPO

Dutch group intends to raise gross primary proceeds of €340m to pay down debt and reduce leverage

Holland Venture Partners sells QSight IT

GP first invested in the cybersecurity company when it was known as QI ICT in 2015

PAI Partners makes fresh bid for Refresco

Non-binding €1.4bn takeover proposal was rejected by the Dutch bottles business in April

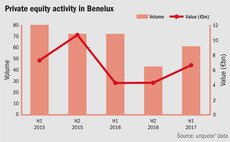

Benelux open for business as trade sales recover

Nine months into 2017, the number of exits to trade buyers exceeds 2016's levels, reflecting healthy European corporate M&A activity

EQT sells TransIP back to founder

GP makes the divestment from both EQT Mid Market and EQT Mid Market Europe funds

Avedon Capital buys and merges VisionsConnected, Viju

Following the merger, the new group expects to generate €100m in annual revenues

Perusa acquires Xindao

GP draws equity from Perusa Partners II, a €207m buyout fund that closed in November 2011

Main Capital sells Connexys to Bullhorn

Main Capital reports that the transaction is one of its "biggest exit successes"

Torqx buys Hoco Parts

Company's directors will take a minority stake in the business alongside management

Infracapital sells Alticom to Cellnex Telecom

Sale ends a six-year holding period for Infracapital after a buyout valued at $100m in June 2011

Dentons hires three new partners

New hires will strengthen the firm's corporate M&A practice in the Czech Republic and the Netherlands

TIIN leads €5m series-A for shipping app SendCloud

Backers include Dutch seed investor henQ and existing shareholder Brabant Development Agency

Gilde sells Viroclinics to Parcom Capital

Gilde sells the Dutch contract research organisation after a four-year holding period

Gilde, PGGM buy Mercachem-Syncom

GP initiated the merger of Mercachem and Syncom simultaneously with the buyout

Waterland holds €2bn final close

Dutch buyout private equity firm closes its seventh fund two months after launching in July 2017

Benelux activity picks up in first half of 2017

Following a slow H2 in 2016, dealflow in the Benelux region is on the up with Belgium in particular seeing increasing activity

AlpInvest hires Bagijn as primaries business head

New managing director is joining from her previous role at Axa Investment Managers

Mentha mulling Optimum sale

Mentha Capital took a majority stake in Optimum in 2014, investing from Mentha Capital Fund IV

Mentha Capital exits Venko Groep

Mentha sells the Dutch business to Clayton Dubilier & Rice portfolio company BrandSafway