Poland

Resource Partners acquires Polish company Nesperta

GP will help the company with its expertise and experience through international and product expansion

Enterprise Investors completes PragmaGo take-private

GP plans to de-list the company from the Warsaw stock exchange "as soon as possible"

TEP Capital to build portfolio of six Polish investments

Poland-based TEP Capital was set up a year ago and is funded by German conglomerate Thomas Gruppe

Omikron buys Polish company Dagat ECO

GP invests in Polish SMEs, particularly production-based and services companies with scalable business models

Advent-backed InPost prices IPO at €8bn valuation

Company has been owned by Advent International, which acquired the company alongside its listed parent company Integer in April 2017

Learn Capital leads $80m series-D round for Brainly

Funds from the round will be used to bring new products to the Brainly community

Mid Europa to acquire Sage Group's Polish business

Software business is valued at £66m and the sale process saw interest from a number of sponsors

Enterprise Investors to carve out Software Mind from Ailleron

GP will deploy equity from its Polish Enterprise Fund VIII, which held a first and final close on €498m

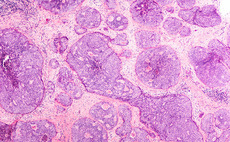

Kartesia in €32m refinancing for Enterprise-backed Nu-Med

Enterprise Investors acquired a minority stake in the oncology company in 2013

Abris Capital buys Scanmed for PLN 340m

GP invests in the company via Abris CEE Mid-Market III, which held a final close on its €500m target in 2017

Innova acquires stake in Bielenda Kosmetyki

Proceeds from the investment will fund the company's acquisition of two cosmetics brands from Norwegian cosmetics group Orkla

Mid Europa buys Polish e-retailer Displate

Company's founders will remain significant minority shareholders of the business

Abris exits locomotive leasing business Cargounit to Three Seas

Polish buyout firm Abris Capital Partners has signed an agreement to sell its stake in Polish locomotive lessor Cargounit, also known as Industrial Division, to Three Seas Investment Fund (3SIIF).

Naxicap's Alwitra to acquire Poland-based CB

According to a competition authority filing, Alwitra is to buy a majority stake in the business

Permira-backed Allegro lists with market cap of €9.8bn

Allegro intends to use the proceeds, alongside a new credit facility, to repay its existing debt

Abris acquires Apaczka from 21 Concordia

21 Concordia bought a minority stake in the Poland-based e-commerce logistics business in 2017

PE-backed Allegro announces intention to float

Poland-based e-commerce platform backed by Cinven, Permira and Mid Europa reportedly aims for €10-12bn valuation

Heal Capital, EBRD in $10.25m series-A for Infermedica

Round also saw participation from existing investors Karma Ventures, Inovo Venture Partners and Dreamit Ventures

CMS hires five in Polish transactions team

All five lawyers have joined from Clifford Chance and will focus on mandates for private equity firms

V4C-backed Kom-Eko buys Lubelska Agencja Ochrony Srodowiska

Value4Capital acquired Kom-Eko from Royalton Partners in November 2018 via its V4C Poland Plus Fund

Resource Partners sells Golpasz to trade

PE firm Resource Partners has been a majority shareholder of Golpasz since 2015

Tar Heel buys 70% stake in Estetique

GP is looking to create a nationwide dental group and intends to sell it in five to seven years to an industry investor

Genesis Capital launches €150m fund

GPEF IV will focus on investments in small and medium-sized companies with high growth potential

Allegro's PE sponsors plan IPO

GPs jointly acquired Allegro from South African media group Naspers for $3.253bn in October 2016