Sunstone Capital A/S

EQT Ventures et al. sell Peakon to trade for $700m

Since being founded in 2015, Peakon raised around $68m from investors including EQT Ventures, Atomico, IDInvest, Balderton and Heartcore.

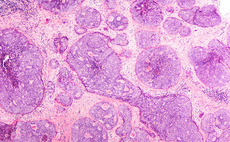

Sanofi et al. back €47m series-B for MinervaX

MinervaX has so far raised a total of $81.5m in funding, including grants

Inven Capial leads Zolar series-B expansion

Household solar energy systems provider has raised €15m to expand its €10m series-B round

Crane leads $5m round for Forecast

Existing Danish investors Seed Capital and Heartcore also participate in the round

VC firms back €20m series-A for Stipe

Novo Holdings co-leads the round with Arix and Wellington Partners, and Sunstone Ventures invest

Notion Capital leads $12m series-A for HeyJobs

Notion Capital typically leads funding rounds with a first investment of $3-5m in startups

Atomico leads €30m series-B extension for Peakon

Investment brings the total volume of Peakon's series-B to тЌ48m, following a round in February 2018

Sunstone holds €80m first close for fourth life science fund

Sunstone Life Science Ventures Fund IV expects to close on its €150m target by early 2020

VCs back Aire in $11m funding round

Crane is joined in the round by existing investors White Star Capital and Sunstone Capital

Kinnevik leads $44m series-C for TravelPerk

Previous backers including Felix Capital, Target Global and LocalGlobe also take part in the round

VC firms back £30m funding round for Orbex

Capital will be used to launch orbital vehicles from the UK's newly announced spaceport

Project A et al. in $4.2m round for Aula

Funding will enable the education-focused online communication company to pursue product development

Sunstone divests stake in Asetek for NOK 150m

VC firm intends to distribute the proceeds of NOK 150m to VУІkstfonden, the Danish growth fund

VC firms sell Prexton to Lundbeck for up to €905m

Vendors include Sunstone Capital, Ysios Capital Partners and Forbion Capital Partners

Balderton leads $22m funding round for Peakon

Round is backed by EQT Ventures, Idinvest Partners and Sunstone Capital

Novo Nordisk-backed Orphazyme lists in DKK 1.6bn IPO

Introductory share price was set at DKK 80 apiece, for a market cap of DKK 1.6bn

Sunstone, Statkraft lead €4m series-A for Zolar

Partech Ventures and entrepreneur Tim Schumacher also take part in the round

Sunstone closes two funds totalling €159m

Sunstone Technology Fund IV held a final close on тЌ112m and will target 30 investments

VC firms back Exporo

Fresh capital will be used to develop new products, including the launch of bonds for larger projects

Sunstone Capital et al. lead €9m series-B for Dubsmash

GP co-led the round alongside Balderton Capital as well as existing investor Index Ventures

Ventech, Inventure, Sunstone in €9.25m series-B for Freespee

Round also saw participation from Silicon Valley Bank, suggesting the funding also included debt

Sunstone and E.Ventures in SEK 50m series-A for Natural Cycles

Funding round for the Swedish startup was led by publisher Bonnierтs Media Growth divison

Tink raises $10m series-B from SEB Venture at al.

Investment firm Creades leads the round alongside SEB Venture and existing investor Sunstone Capital

Sunstone sells Tyba to Graduateland

Tyba’s management team will leave the business for a spin-off company, Source{d}