Switzerland

Alpana invests CHF 6m in Lend

Geneva-based VC firm supports European startups with international expansion strategies

CIC buys printing machines manufacturer Hunkeler

Stefan and Michel Hunkeler will retain a joint majority stake in the family business

Jadeberg sells MCS to trade

Sale generates a gross IRR of 33% for Jadeberg over its holding period of two-and-a-half years

Swiss crypto bank SEBA raises CHF 100m

Black River Asset Management, Summer Capital and a host of other investors took part in the round

VC firms back $30m series-C for Nozomi Networks

Latest financing comes just months after a $15m series-B, closed in January this year

DACH funds still proliferate despite fundraising lull

Fund launches remain at near record levels in the region, as GPs look to further specialisation in order to stand out

Atomico, Keen Venture lead $13m Beekeeper series-A extension

Round is also supported by a group of strategic investors including Samsung Next and Swiss Post

Capvis holds final close on €1.2bn

Significant increase on Capvis IV, which launched with a €600m target in February 2013

Investcorp buys minority stake in Swiss bank

Bank will be renamed Banque Pâris Bertrand SA, and will remain operationally independent

Waterland opens new office in Zurich

Opening of the Swiss base follows the inauguration of offices in Manchester and Copenhagen

Onex-backed SIG to float in €1bn IPO

Primary offering would target proceeds of approximately €1bn, going towards deleveraging

Aslanoba Capital et al. back Colendi

Turkey- and UK-based VC firms inject $2.5m into the Zug-based credit scoring platform

Jadeberg Partners goes deal-by-deal

Jadeberg will invest the proceeds of divesting its second fund on a deal-by-deal basis

Therachon nets $60m mezzanine from Novo et al.

Existing investors Versant Ventures, OrbiMed, BPI France and Inserm Transfert Initiative also take part

CGS-backed ICG acquires Freeman Schwabe

ICG intends to strengthen the company's business with a focus on the North American market

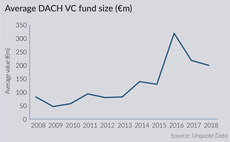

VC fundraising lifts off in DACH region

Six venture funds based in the DACH region have held final closes in 2018 for a combined €1.3bn

DACH leads lower-mid-market fundraising

An overcrowded lower-mid-market in the Nordic region and the UK, coupled with Brexit, has boosted DACH fundraising activity

GV et al. in $30m series-B for Scandit

Incoming investor NGP Capital and existing backer Atomico also take part in the funding round

Afinum sells Copytrend

Sale is an exit for the GP's fourth buyout fund, Afinum Siebte Beteiligungsgesellschaft

VC firms in $25m round for Polares Medical

Earlybird Venture Capital, Wellington Partners and Endeavour Vision also take part

Palamon acquires FairConnect

Company expects to double its user base this year and accelerate expansion across verticals

Paragon buys stake in Asic Robotics

Shareholders STS Management and Renaissance Anlagenstiftung will remain invested alongside Paragon

Partners Group's private equity AUM increases 7%

Switzerland-based firm announces тЌ2.37bn new commitments for its private equity strategy

VC firms back CHF 13.7m series-A for Allthings

Round is led by Earlybird and Idinvest Partners with participation from Kingstone Capital