Switzerland

Forbion, Seroba co-lead €29m series-B for Prexton

Backers include existing investors Merck Ventures, Ysios Capital and Sunstone Capital

Unigestion acquires Akina in $6bn AUM merger

Merged group will have $6bn in assets under management and will trade under the Unigestion brand

Bregal buys Swiss watches and jewellery retailer Embassy

Deal marks the sixth investment overall and the second in Switzerland for the GP

Akina closes Euro Choice VI on €410m

Fund previously held interim closes on €180m and more than €200m before the final close

Capvis buys majority stake in Felss Group

Deal saw the GP provide capital from its 2013-vintage Capvis Equity IV vehicle

Zurmont Madison leads fund restructuring, launches new vehicle

LPs have been offered the opportunity to cash out or roll over to the new vehicle, ZM Opportunity II

HQ Equita sells Stettler to Groupe Imi

GP sold its controlling stake in the business via a trade sale after five-year holding period

Adveq closes Adveq Europe VI on €462m

GP closed Adveq Specialised Investments and Adveq Europe Co-Investments earlier in 2016

Apax Partners buys Unilabs from Nordic Capital and Apax Partners France

As part of the deal, Nordic Capital and Apax Partners France fully exited the business

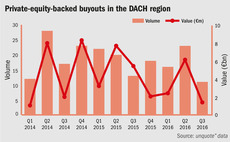

DACH buyouts on the rise throughout 2016

Despite low dealflow, the region saw an increase in buyouts during the course of the year, as aggregate value remained resolute

LGT hits $2.5bn first close for Crown Global Secondaries IV

According to a statement, the GP is eyeing a final close on the $2.8bn hard-cap in H1 2017

Swiss PE optimistic despite concerns over investment conditions

GPs and LPs discussed the state of Swiss PE at the Mergermarket Swiss M&A and PE event in Zurich

Polytech in $9.7m series-A for Ava

Other Swiss and American investors joined Polytech in the series-A round

HgCapital invests in Fundinfo

HgCapital invested via its Mercury fund, which targets lower-mid-market companies

Ufenau closes fifth buyout fund on €227m

Ufenau holds final close for fifth fund on €227m after four months of fundraising

Horizon et al. invest $28m in FinanceFox

Funding will be used for further expansion and to boost its marketing efforts

Bregal buys Kunststoff Schwanden

Management buyout sees Bregal Unternehmerkapital acquire a majority stake

Gimv invests €30m in Spineart

Investment marks Gimv's fourth investment in the healthcare space this year

Equistone acquires fire proofing business Roth

During Ufenau's ownership, Roth made four add-ons in different Swiss regions

DACH buyout dealflow hits 15-month high in Q2

Buyout volume and aggregate value were up by 43% and 155%, respectively

Apax-backed InfoVista acquires Ascom's Tems subsidiary

Apax France acquired a majority stake in the group in March 2016

ProteoMediX raises CHF 5m from Altos Venture et al.

Altos has been backing the Zurich-based diagnostic tests company consistently since 2012

Akina holds interim closes on three Euro Choice funds

All three funds are expected to hold a final close by the end of the year

Emeram buys Swiss technology business Xovis

Xovis now hopes to enter sectors such as transportation and facility management