Unquote Data

France: Private debt still thriving despite muted fundraising

Current fundraising pipeline and recent investment statistics suggest the French private debt space is still in rude health

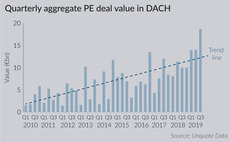

DACH activity skyrockets in Q3 despite looming recession

Aggregate value in DACH for Q3 reached its second highest level at €18.7bn

Q3 Barometer: deal volume hits new record with mid-market push

Buyout market has been strengthening consistently and was only four deals away from hitting 300 in the third quarter

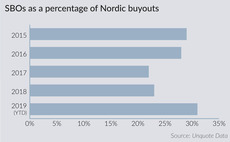

"Pass-the-parcel" deals surge in Nordic region as PE matures

At nearly a third of all buyouts, the proportion of SBOs is now higher in the Nordic region than it is across Europe as a whole

H1 Review: Deal volume steady in southern Europe; value drops

Region recorded 70 buyouts worth an aggregate value of €11.2bn in the first six months of the year

H1 Review: Nordic pricing frothy as cross-border capital pours in

Nordic region retained its position as the most expensive place in Europe for private equity firms to buy companies in Q2 2019

H1 Review: Fundraising and local capital herald CEE buyout revival

Baltic market stands out, recording a higher than usual share of the wider region's dealflow

H1 Review: Large-cap value drives Benelux buyout activity

H1's aggregate value of €11.1bn resulted in a 60% increase on H2 2018, and reveals large-cap activity remains strong in the region

H1 Review: GPs seek sourcing alternatives in busy French market

While French PE performed well, GPs lost out to corporate buyers on more deals than usual

H1 Review: UK transactions hit by Brexit impact

Total of 96 buyouts recorded by Unquote Data during the period marks the lowest volume seen in the country since H1 2016

Q2 Barometer: small-cap boom offsets mid-market lull

Europe records 533 buyout, expansion and early-stage investments over Q2, a nine-quarter low

Nordic region sees highest entry multiples for sixth quarter running

Q2 edition of the Clearwater International Multiples Heatmap finds a slight cooldown across Europe, though the average multiple still exceeds 10x

France gearing up for a carve-out comeback

EY's recently published Corporate Divestment report makes encouraging reading for French GPs looking for corporate carve-out opportunities

CEE GPs use minority transactions to boost dealflow

Dealflow bolstered by the creativity of private equity firms, willing to team up or take minority stakes

UK Fundraising Report: Weathering the Brexit storm

Latest Unquote UK Fundraising report, published in association with Aztec Group, is now available to download

CEE buyout market picks up after record low in Q1

Dealflow has rebounded, but pricing expectation mismatches are still an obstacle to overcome

UK exits on hold in Q1

Exit activity reached its lowest quarterly level since the height of the financial crisis in Q1, according to Unquote Data

Annual Buyout Review: aggregate value reaches new peak

Unquote's lastest Annual Buyout Review, offering in-depth statistical analysis of European buyout activity in 2018, is now available to download

Nordic giants drive region's aggregate value jump

Aggregate value of buyouts in the Nordic countries jumped to тЌ25.7bn in 2018, a 66% increase on 2017

Large-cap deals turbo-boost Benelux buyout market

Deals valued at more than €500m reached a post-crisis peak last year, even setting aside Carlyle's €10bn AkzoNobel carve-out

Secondaries in Private Equity

Unquote analysis of the secondaries market is now available for download

Multiples Heatmap: winter cooldown across Europe

Latest Multiples Heatmap, published in association with Clearwater International, is now available to download

Strong LP appetite and creative credit to fuel DACH growth

Despite stiff competition for assets, PE firms in the DACH region hit record deal volume in 2018 and expect further growth in 2019

Strong Italian dealflow boosts southern European activity

Italy reached an all-time peak in terms of buyout dealflow and aggregate value in 2018, boosting the region's figures as a whole