Unquote Data

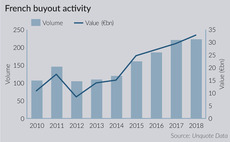

French buyout value climbs to post-crisis peak

Total deal value comfortably surpasses 2017's figure in a market driven by fierce competition, high prices and easy access to debt

Baltic buyouts boom as CEE slumps

Dealflow in the wider CEE region slumped in the first three quarters of 2018, but Baltic states enjoyed an uptick in activity

Multiples Heatmap: DACH deals, mega-buyouts drive inflation

Latest Multiples Heatmap, published in association with Clearwater International, is now available to download

Taking stock of 2018: a year of contrasts

Tallying up investment activity and fundraising levels over the past 12 months reveals two contrasting trends at play

French PE market overtakes UK

With a stark drop in H2, the UK's buyout volume looks certain to finish the year short of 2017's total

PE and the banking sector: a challenging marriage

Fund managers are increasingly investing in the banking space, despite regulatory challenges and potential conflicts of interest

Brexit apprehension brings sharp drop in UK deal activity

Country suffers a larger drop-off in aggregate buyout value than any other European region in the first 11 months of 2018

DACH region rises up Europe's PE ranks

Frankfurt proves the most popular city, with KKR, Astorg, Idinvest et al. opening offices in the city

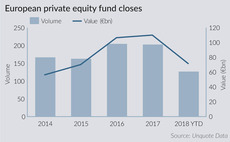

European fundraising cools down after bumper 2017

Number of fund closes by European PE firms and their aggregate commitments have slowed down during 2018, following two years of relentless activity

Dutch small-cap buyouts see values soar

First three quarters of 2018 saw combined value almost reach 2017's full-year total, which was in itself a five-year peak

UK sub-£100m buyout volume rebounds

Dealflow for transactions in the lower price range hit a post-crisis quarterly peak in Q3

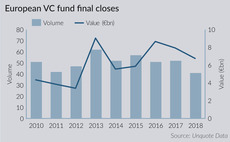

European VC fundraising continues strong showing

VC fundraising totals over 2016-2017 marked a healthy increase of nearly 50% on the amounts raised in the previous two-year period

Secondary buyouts back on the scene in CEE

H1 2018 saw the second highest half-year volume of SBOs since the financial crash, rebounding from two consecutive semesters of low activity

European buyout value reaches post-crisis high

Deal value has been boosted by a spike in тЌ1bn+ deals and strong activity in Southern Europe

Creative Credit in Private Equity

Creative Credit in Private Equity is now available to download for our subscribers

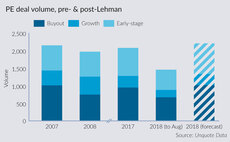

Then and now: European private equity's post-Lehman decade

European PE came to a virtual standstill 10 years ago, but figures show the asset class has all but recovered its pre-crisis appeal

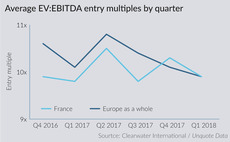

French mid-cap seeks new approaches as competition heats up

Buy-backs edge into the French mid-market, as H1 activity hits record highs and entry multiples swell

BGF on track for busiest ever year

With five months to go, the UK investor is already just a few deals shy of its record deployment year

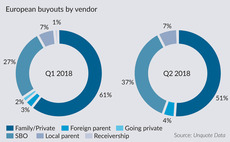

Record SBO numbers helped drive buyout dealflow in Q2

Q2 2018 saw 94 buyouts sourced from other GPs, setting a new quarterly record for European private equity

Record number of French SBOs and mega-deals in H1 2018

France's year is going from good to great as new figures from Unquote Data show buyout volumes reaching their highest level for a decade

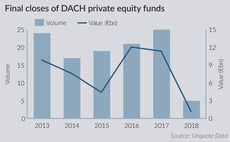

DACH Fundraising Report 2018

Private equity fundraising in the DACH region continued to build on strong momentum in 2017

DACH fundraising picks up steam after slow Q1

Funds holding final closes in Q2 have surpassed the total amount raised in the first quarter of the year, following a strong 2017

Q1 entry multiples drop to lowest level since Q1 2016

PE deal valuations drop for the third consecutive quarter, as the Nordic region continues to see the highest entry multiples

Italian PE enjoys vibrant Q1 despite political uncertainty

Buyout and exit activity in the country ballooned in the first quarter of 2018, despite the prolonged uncertainty surrounding the general election