Venture

Maven leads £5.3m funding round for E Fundamentals

Existing investors Downing Ventures and Scottish Enterprise also invest in this round

Albion VC leads £6.35m series-A for Speechmatics

Company plans to use the funding to further boost its product development and geographical expansion

Eutopia raises €50m across two funds

French VC Eutopia raises funds following its spin-out from Otium Capital in early 2019

Insight invests $145m in CommerceTools

Rewe Digital, which acquired a stake in the software provider in 2014, remains a shareholder

EVentures, XAnge lead $6.6m round for Apiax

Regulatory technology startup Apiax raised its first institutional funding round in 2017

UK late-stage venture boom offsets early-stage lull

Second quarter saw an average value per deal of ТЃ30.7m, significantly higher than the 10-year average of ТЃ11.8m

LauncHub Ventures raising new €70m fund

New fund has €25m committed to date and hopes to close in Q1 or Q2 next year

Sofinnova closes Sofinnova Capital IX on €333m

Fund backs biopharmaceutical and medical devices startups, mostly in Europe and the US

Idinvest holds €350m final close for Digital Fund III

Fund is more than twice the size of its predecessor, Digital Fund II, which closed on €154m in 2015

Santander InnoVentures et al. back €35m CrossLend series-B

Round also includes funding from existing investors Lakestar, ABN Amro Ventures and Earlybird

Xerys, Siparex et al. close $18.6m series-B for Herow

Backers close a $18.6m round started in 2015 with an initial $10.6m capital injection

BIVF, Gründerfonds Ruhr lead €12m series-A round for Abalos

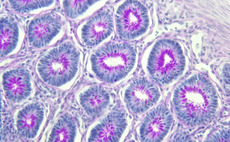

Abalos Therapeutics is a biotechnology company focused on developing immuno-oncology therapeutics

Ahren et al. in $16m round for Mogrify

Biotech's series-A is supported by a consortium of investors led by existing backer Ahren

Hiro holds first close for debut fund

Hiro Capital I is a fund focused on the games and digital sports technology sectors

Nauta Capital leads €3m series-A for World Mastery

GP deploys capital from its Nauta IV Tech Invest fund, which closed on €155m in April 2017

Greenoaks leads €50m series-B for Casavo

Company plans to use the financing to boost its expansion by opening new agencies across Italy

Northzone in €17m round for Matsmart

Round was led by LeadX Capital Partners with Ingka Group, D-Ax and Norrsken also taking part

Spark Capital invests $15m in tablet startup Remarkable

Company plans to use the fresh capital to scale up its team and invest in product development

83North leads €15m series-B for CRM platform Critizr

Previous backers Point Nine, Caphorn Invest and Runa Capital also take part in the investment

Edenred leads CHF 14m series-B for Avrios

Lakestar, Notion Capital, Swisscom Ventures and Columbia Lake Partners also took part

Beyond targets €100m for second fund

Beyond Capital Partners has launched its second fund, which will invest a maximum of €15m in equity

GED Capital raises €20m for first VC fund

Conexo Ventures I targets series-A rounds in Iberian startups which develop disruptive software

UVC takes part in €15m round for Fazua

European Investment Bank has led the round by providing the company with €12m of venture debt

VC consortium backs $60m series-B for Tier

Round is led by Mubadala Capital and Goodwater Capital, with all existing investors taking part