Analysis

Deal in Focus: Qualium and CDC IC acquire Vulcanic

Pass-the-parcel deal marks the fourth consecutive period for the French cooling systems group under private equity ownership

Italian pre-IPO fund eyes first close on €120m

Fund will acquire 30% stakes in 8-10 mid-sized companies targeting launches on the AIM segment of the Italian stock exchange

Luxembourg launches Reserved Alternative Investment Funds

New vehicles will increase flexibility and open up opportunities for private equity houses, real estate investors and hedge fund managers

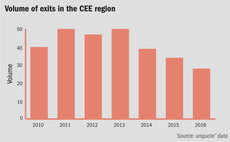

CEE could arrest exit flow decline in 2016

Region is seven exits short of exceeding 2015’s total for PE- and VC-backed exits

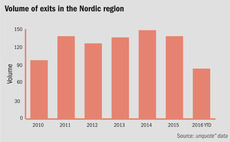

Nordic exits facing slump in 2016

Market needs strong fourth quarter numbers to surpass last yearтs exit volume and avoid a five-year low

In Profile: CBPE Capital

unquote" takes an in-depth look at the GP behind nine fundraises and discusses strategy with managing partner Sean Dinnen

Italy's restructuring deals turning debt market around

The country is still suffering from a legacy of sub-performing loans, though new regulation should allow credit funds to emerge

Hedging against Britain's volatile IPO outlook

UK IPO market has experienced highly unpredictable activity throughout September and October

Private equity's public market problems

Despite strong investor appetite for listed private equity houses, life on the public markets brings with it numerous challenges

Deal in Focus: JC Flowers backs MMC's Interactive Investor

VC introduced a new majority shareholder to accelerate company's market consolidation strategy

LP Profile: ATP

Danish pension fund is among Europe’s largest but does not prescribe asset allocation targets

France eyes corporate venture boost

Recent changes to regulation should encourage more of the country's corporate players to ramp up their venture activity

In Profile: NorthEdge

unquote" takes an in-depth look at the northern GP, which scored Best Fundraise at the British PE Awards last week

UK mid-market funds: Higher tiers risk overload

UK core mid-market may have to deal with the risk of LP fatigue and rising valuations, as the space becomes increasingly competitive

UK lower mid-market fundraising: Making the leap

Low levels of secondary buyout opportunities will intensify challenges for private equity firms raising increasingly larger vehicles

In Profile: Silverfleet Capital

unquote" talks to managing partner Neil MacDougall about fund performance, recent activity and strategy

Fund in Focus: Ardian raises €4.5bn for sixth LBO Fund

France-based GP has an additional €500m co-investment pocket for LPs in its latest vehicle, accounting for around 15% of the fund

German VCs welcome loss carry-forward reform

New law will increase the number of situations in which companies can carry forward losses from one tax year into another

Online food-ordering services feeding Benelux's IPO surge

GPs and VCs are capitalising on the improved climate for the public market exit route

LP Profile: Adveq

unquote" catches up with fund-of-funds manager Adveq to discuss strategy, first-time funds and co-investments

Nordic GPs look to new verticals in private healthcare

GPs in the region are increasingly turning to new healthcare subsectors as the private care segment evolves into a large-cap game

French PE: dealing with rising transaction costs and valuations

Extensive due diligence and increased valuations reflect the country's increasingly complex and competitive deal-making environment

Romanian buyout activity shows no signs of picking up

Macroeconomic factors, combined with a dearth of dealmakers, are limiting the growth potential of Romanian private equity

Deal in Focus: Kartesia supports ProFagus expansion

Alternative lender bets on its existing network in locating German deals, as it supplies a debt replacement package for Steeadfast-backed ProFagus