Official Record

Capnamic, Grazia in $8m round for Zageno

Fresh capital will be used to expand the sales, marketing and technical integration teams

Primomiglio leads €1m seed round for Yolo

Backers include US-based seed investor Miro Ventures and insurance broker Mansutti

HQ Equita sells Rovema to Haniel

Rovema reports double-digit growth percentages in the two years since HQ acquired it

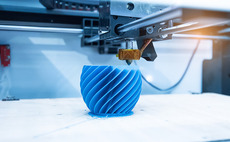

NPM Capital invests in Ultimaker

NPM will become a majority shareholder as the three founders remain as shareholders

FPE closes maiden fund on £100m

UK-focused vehicle will target buyout and growth investments in companies with EVs of ТЃ20-50m

Draper Esprit acquires two Seedcamp funds

Deal sees the acquirer take stakes in a number of tech startups, including Transferwise

Gimv, UI Gestion sell Almaviva Santé to Antin

Gimv and UI Gestion sell the French private hospitals group to Antin Infrastructure Partners

Endeit leads $10m series-B for Tourradar

Existing investors Cherry Ventures and Hoxton Ventures also take part in the round

HgCapital buys 69% Dada stake for €46m

Following the acquisition, the GP aims to launch an offer on the remaining shares

VC firms invest €3.6m in Blickfeld

Fluxunit, HTGF, Tengelmann and UnternehmerTUM all take part in the funding round

BC Partners acquires MCS

GP acquires a 90% stake in the French bank loans portfolio management company

Innova Capital acquires Inelo and OCRK

GP intends to growth the firms' expertise and technology domestically and globally

Global Founders in £36m Nested round

Online estate agent will target expansion in London before looking to grow across the UK

Invitalia hits €87m final close with EIB commitment

Fund has already invested €11m in 16 Italian startups and currently has €33m in AUM

Premium Equity Partners acquires IC! Berlin

Co-founders Ralph Anderl and Jörg Reinhold retain a minority stake in the company

Circularity and Mustard Seed co-lead $7.4m round for Winnow

Business will roll out its software for tracking food wastage across new international markets

Alto Partners hits €152m second close for fourth fund

GP eyes a final close for Alto Capital IV by the end of the year, on its €200m target

Auven leads $200m round for ADC Therapeutics

Hedge fund Red Mile, the Wild Family Office and VC Astrazeneca also back the round

Maven injects £3m into Altra

Capital will support the launch of the group's structured trade credit insurance brokering division

BPI France and UI Gestion acquire Theradial in MBO

GPs jointly acquire a majority stake in the French medical equipment distributor

VC firms sell Miflora to Blume 2000

Selling shareholders include Atlantic Capital, HR Alpha Ventures, Heilemann Ventures and BayBG

Alpina acquires Syncos

GP invests via holding company that acquired ERP software providers Oxaion and Cimdata

Equistone's TriStyle bolts on Basler

TriStyle intends to strengthen Basler’s position in the German market

Mandarin's Italcer bolts on Devon&Devon

Deal is the third bolt-on for the Italian private equity-backed ceramic group Italcer