Research

Italy Fundraising Pipeline - Q4 2020

Unquote compiles a round up of the most notable fundraises ongoing across the Italian market

DACH Fundraising Pipeline - Q4 2020

Unquote compiles some of the most notable fundraises in the DACH region in the buyout, venture and secondaries spaces

European Direct Lending Perspectives Q2 2020

Debtwire and Creditflux examine the way direct lenders reacted to pandemic-related upheaval and how the industry looks set to bounce back

UK Fundraising Pipeline - Q4 2020

Unquote rounds up the most notable fundraises currently ongoing in the French market across the buyout, venture and secondaries spaces

France Fundraising Pipeline - Q4 2020

Unquote rounds up the most notable fundraises currently ongoing in the French market across the buyout, venture and secondaries spaces

Multiples Heatmap: pricing ticks up as GPs flock to safe assets

Although dealflow was severely impacted by Covid-19 in Q2, average entry multiples actually went up given the scarcity of attractive opportunities

Private Equity Pitch: Funds exposed to UK consumer services providers

Unquote and Mergermarket look at individual funds' exposure to UK businesses in the consumer services space

Q2 Barometer: Coronavirus ravages European M&A market

After the first effects of the Covid-19 crisis were felt in March, the European private equity market decelerated sharply in Q2

Nordic PE exits hit new low in Q2

Volume of exits by PE firms across the Nordic countries in Q2 2020 fell to its lowest point in more than a decade, according to Unquote Data

DACH buyout market weathers Covid-19 impact, UK and France suffer

Germany emerged as the busiest region in Europe in Q2, albeit with a low volume and aggregate value of deals by historical standards

PE exits hit decade low in Q2

Volume of exits by PE players across Europe fell by 43% year-on-year in Q2 2020 as the coronavirus crisis took hold, according to Unquote Data

Italian PE: an opportunity in crisis

The latest edition of Gatti Pavesi Bianchi's series on the Italian private equity and M&A markets is now available to download

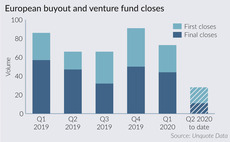

European fund closes slump by 42% amid lockdown

Unquote recorded 44 first or final closes of European PE funds between March and May, a 42% drop on the three-month average seen across 2019

Impact Investing Report 2020

Unquote has now released its inaugural Impact Investing Report, published in association with the Aztec Group

Q1 Barometer: Year of sustained growth finally halted in Q1

The European private equity market cooled in Q1, even before the Covid-19 crisis took hold, after an especially active Q4 2019

Half of GPs prepared to hire based on video interviews - survey

Survey conducted by PER shows that 52% of participants could make offers from video interviews

Delays in cross-border carve-outs add hefty surcharge – report

An average 16% of deal value drains away when processes over-run for more than four months, according to a recent TMF report

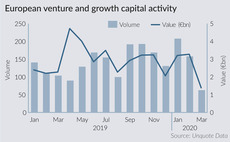

VC, growth activity collapses in March amid Covid-19 outbreak

European VC and growth capital dealflow was no more sheltered than its buyout counterpart

Annual Buyout Review: European momentum likely to be hit hard

Unquote's lastest Annual Buyout Review is now available to download, offering in-depth statistical analysis of European buyout activity in 2019

Secondaries buyers expect 30% volume drop over next two months - research

Five out of 37 buyers still appear opportunistic and expect activity to go up

Failed auctions accelerate as sellers' market peaks – research

UK accounts for 54% of failed auctions since 2015, according to the Investec research

Secondaries deal volume up 7% in 2019 – research

Setter Capital's latest research reveals continued momentum in private equity secondaries, with 2020 set to be another record year

DACH Fundraising Report 2020

DACH private equity fundraising was in rude health in 2019, with 26 funds securing a combined €13bn across all strategies for the region

Q4 Barometer: Continued buyout bonanza tops record-breaking year

Private equity investors completed 807 deals in Q4 2019, tipping the year into record-breaking territory