Research

Tech overtakes consumer in Italy

Numerous Italian GPs with a generalist approach have reshaped their activity towards the tech sector

Buyout rankings: who invested the most in Europe in Q1 2021?

Unquote tallies the top 10 most active GPs across the European buyout space in the first quarter

SBOs, mega-deals fuel strong Q1 for French buyouts

While the sharp quarter-on-quarter rebound of late 2020 was not replicated, the French market remained buoyant in Q1

UK buyout rankings: who invested the most in Q1

Unquote tallies the top 10 most active GPs across the UK buyout space in an exceptionally busy first quarter

Quiet market for final closes in Q1, as backlog of funds on the road grows

The number of final closes for European PE funds was down by 22% year-on-year in Q1 2021

UK buyout activity sets new record in Q1

UK buyout market is truly back in full swing, according to preliminary figures from Unquote's proprietary database

Q4 Barometer: How European activity returned to pre-pandemic level

European PE deal value staged an impressive recovery over the course of 2020, capped by a busy Q4

Iberia Fundraising Pipeline - Q1 2021

Unquote compiles a roundup of the most notable fundraises ongoing across the Iberian market, including Magnum, MCH, Suma and more

Nordic Fundraising Pipeline - Q1 2021

Unquote rounds up notable fundraises ongoing across the Nordic market, including EQT, Axcel, CapMan, Saga, and more

UK & Ireland Fundraising Pipeline - Q1 2021

Unquote rounds up the most notable fundraises currently ongoing in the UK & Ireland market across the buyout, venture and debt spaces

European fund launches off to slow start in 2021

Number of PE funds launched by European managers in Q1 this year is significantly down on the volume recorded for the same period in 2020

Italy Fundraising Pipeline - Q1 2021

Unquote compiles a round up of the most notable fundraises ongoing across the Italian market, including Clessidra, Quadrivio, Mandarin, and more

DACH Fundraising Pipeline - Q1 2021

Unquote compiles a roundup of the most notable fundraises ongoing across the DACH market, including Capiton, Afinum, Gyrus, Cipio, and more

European Direct Lending Perspectives Q4 2020

Only 9% of market participants anticipate coronavirus negatively impacting fundraising in 2021, with a majority expecting deployment to pick up

Quantifying PE's appetite for recurring revenue models

Buyouts in sectors where recurring revenue models are predominant went from 8% of European volume in 2010 to 22% in 2021 to date

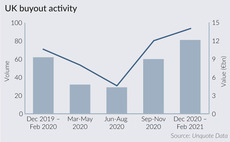

How UK PE buyouts soared ahead of 2021 Budget

Amount of dealflow in the past three months is significantly higher than in previous December-February periods

Multiples Heatmap: average pricing hits 11x in busy Q4

Healthcare, financial services and TMT assets continue to drive valuations up, while Nordic and UK regions see highest multiples

Covid-19 impact expected to be more severe than GFC – survey

Almost all Dechert survey respondents expect distressed deals to increase, while 82% cited more deal delays as an ongoing effect

Iberia Fundraising Pipeline - Q4 2020

Unquote compiles a roundup of the most notable fundraises ongoing across the Iberian market

Q3 Barometer: Green shoots emerge

Aggregate value of deals was noticeably up in Q3 as the reopening of debt markets boosted transaction sizes

Multiples Heatmap: average entry multiple hits 10.5x as dealflow recovers

The UK and Ireland was the hottest region for multiples in Q3, also seeing the largest increase in valuations of any region

Nordic Fundraising Pipeline - Q4 2020

Unquote compiles a round up of the most notable fundraises ongoing across the Nordic market

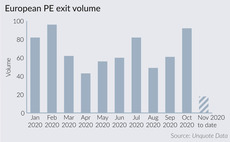

Private equity ramps up divestment efforts

Exit activity jumped by 50% in October, back to pre-pandemic levels, according to Unquote Data

Buyout rankings: who has invested most across Europe since April?

EQT, Ardian and KKR remained very active and struck sizeable deals amid the coronavirus turmoil