Corporate venture divestments: a new source of dealflow?

The technology market could be set to enter a down cycle that would lead to a wave of corporate divestments, argues Cipio’s Roland Dennert. Kenny Wastell reports

In recent years, venture capital firms have been forced to adapt to the latest wave of corporate investors. As a result, some houses are nurturing relationships with corporates as a source of fundraising. Seventure, for instance, recently closed a €100m biotech fund that received an LP commitment from dairy business Danone.

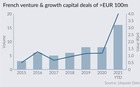

Further intensifying the competition European venture capitalists are facing, Google set aside $30bn for non-US acquisitions last year. Elsewhere, BMW Group recently reaffirmed its commitment to the start-up scene by launching the Munich-based TechFounders accelerator programme, complementing its BMW i Ventures arm. On recent evidence, it certainly appears the advance of corporate players is likely to continue.

Despite this, Roland Dennert, a managing partner at direct secondaries investor Cipio, believes the latest wave of corporate venture, like its predecessors, has a shelf life. "Markets in general are cyclical – in particular, the tech market," he says. "That is not something that is going to change. There will be a period where people are investing, things are going well and multiples rise. The market eventually reaches a point where investors realise the risks are too high, valuations are too high, or returns are not what they were hoping for; and we enter a down cycle."

Dennert believes the turning point for the technology market in particular may be just around the corner, citing the sheer volume of investors currently active in the sector. While he does not believe we are currently in the midst of a bubble, he does foresee a correction on the horizon. "There is a lot of capital to be deployed, multiples are growing higher and there are only so many Ubers out there. At some point, there will be a high-profile investment that will not work out. That will lead to readjusted expectations and could set off a period of divestments."

Learning from past mistakes

However, this view is not shared by Howard Palmer, a partner in the corporate technology team at law firm Taylor Wessing. He believes the latest wave of corporate players have learned from past mistakes and are now looking at longer-term investments. Furthermore, Palmer argues the flexibility afforded to many corporates by the lack of a typical 10-year fund structure puts them at an advantage to most traditional venture houses when it comes to navigating any impending down cycle.

"Corporate divestments are not something I foresee in the short term, barring any unexpected big economic movements," he says. "At the moment corporates are looking to make strategic investments. Certainly, in conversations you hear corporate venture players are now committing for a longer investment cycle than they have historically."

Palmer's assertion that global businesses are still actively seeking to increase investment activities is supported by recent developments. Social media company Twitter made its maiden venture investment in March, when it took part in an $80m round for mobile operating system Cyanogen. Meanwhile, less than a week later, Japanese techology giant Fujitsu announced the launch of its investment fund, a ¥5bn (€38m) vehicle.

Far from seeing this as a threat to traditional venture capital funds, Palmer highlights an evolution that has taken place in response to the trend. "Setting aside more established investors, such as Intel Capital, most corporates are more comfortable investing alongside a financial investor – and it is often the financial investor that will lead the process in those cases," he says. "Where there is competition to invest, some firms may lose out in processes, particularly as a result of rising valuations, but there's actually quite a nice synergy between financial and strategic investors."

Cipio's Dennert stresses his forecast does not apply to more established corporate venture firms, such as Intel and Google. "There are a few select players that are well-established and are managed by very senior professionals, often with direct access to board members," he says. "These investment arms are highly unlikely to struggle or disappear tomorrow. On the other hand there are corporates, which may be a bit newer, that have promoted people from within to make investments and oversee portfolios. Quite often these are not people with sufficient seniority, nor the correct entrepreneurial or investment experience."

Redundancies vs divestments

According to Dennert, in the event of a market correction and declining returns for technology acquisitions, a corporate's venture arm is likely to be one of the primary candidates for reducing expenditure. He cites a potential scenario where – in order to reduce expenditure – the board of a struggling company will weigh the possibilities of either making its employees redundant or divesting an investment arm that may not be generating returns.

In this respect, Taylor Wessing's Palmer is in agreement. "There may well be instances where a management team at a company that has previously committed to corporate venturing changes strategy. That could be a case of an incoming CEO making a decision to change course, or an individual company entering financial difficulties and having to balance the books," he says. Palmer, however, does not believe there are signs that such a trend is forthcoming, let alone ‘just around the corner'.

Over the past 12 months, various industry commentators have speculated that we could be set for a correction of the technology market. The most recent company to fuel the debate is photo- and video-messaging company Snapchat. The business has recently been exploring a fundraising round that could value it at more than $16bn, according to the Financial Times.

The argument that we are approaching such a correction could conceivably be correct; and given the current investment activities of corporates it is likely they would feel the effects. Whether those effects would be strong enough to trigger a wave of corporate divestments remains to be seen. With fewer constraints than traditional funds and plenty of financial muscle, today's corporate venture players are no pushovers.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater